China: Understanding the elephant in the room

Megan Ie

Senior Equity Analyst

Seeing the whole elephant

As we approach the Lunar New Year, we celebrate the Year of the Horse. However, it is another animal that seems to come to mind when currently thinking about China. The world’s second largest economy with a gross domestic GDP of approximately $19.23 trillion in 2025[1], seems to me to be the elephant in the room.

This is fitting given President Xi recently used the parable of the blind men and the elephant when welcoming 18 new ambassadors to China[2]. Each man touches one part and thinks they have understood the whole. One grabs the trunk and calls it a snake. Another feels the leg and calls it a pillar.

Xi emphasized that China is a country with rich diversity. "Only by forming a full and comprehensive picture can one truly understand the real China”. We believe this also applies to investors too: stop trying to make China fit your own preconceptions.

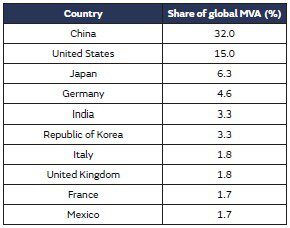

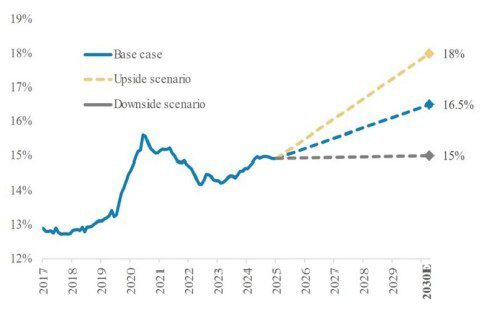

The elephant quantified: China’s dominant manufacturing share and projected export lead into 2030

Chart 1[3]: Top 10 countries with the largest manufacturing sector and their share in global Market Value Added (MVA) in 2024

Chart 2[4]: China global export market share (% 12M trailing sum)

The gap between perception and reality

Most of the world still treats China as a binary bet: in or out, bullish or bearish. It’s comfortable because it requires no real underwriting and no ongoing work.

It also misses what matters.

China is doing contradictory things at the same time: deflating property while funding industrial policy; building world-class EV and manufacturing ecosystems while managing local government debt; letting equity markets trade through fundamentals for long stretches while, at moments, pricing political risk with brutal efficiency.

Those contradictions create a gap between headline risk and company reality.

Inside that gap are quality businesses trading at distressed expectations over fixable issues: governance that can be strengthened, incentives that can be improved, disclosure that can mature, and regulatory posture that can be clarified. These mispricings persist because many investors see “China risk” and walk away.

We ask narrower questions: What’s actually broken? Can it be fixed? And can we help?

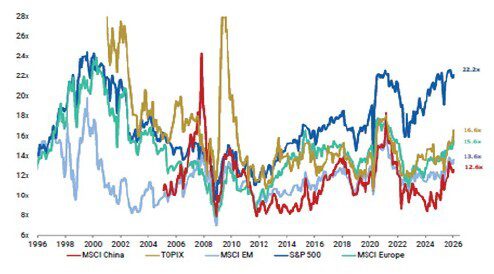

MSCI China still trades at discounts to other major global equity markets

Chart 3[5]: 12 month Fwd PE

What engagement actually means

Our approach is simple: buy quality businesses mispriced for fixable reasons, then work with management to close the gap.

A concrete example is an online recruitment platform - a matching infrastructure that connects job seekers with employers. It listed just as Beijing began tightening its posture toward parts of the platform economy. The sector derated, the stock collapsed, and “Chinese internet” became shorthand for “uninvestable.”

We began building our position at the start of 2024. The set-up was unusually clean: the business was being valued as if its shareholder contract would never improve, despite having ~27% of its market cap in cash. That cash wasn’t a footnote - it was the margin of safety and the fuel for self-help, if management chose to use it.

The question wasn’t demand. It was whether governance, incentives, and regulatory positioning could get to a place the market could trust.

So we engaged. Quietly and practically. We set clear priorities in writing, kept up regular check-ins virtually and physically, tracked actions (not promises), and escalated only if progress stalled.

The focus was straightforward:

- Capital allocation. If the balance sheet is strong, volatility can be an opportunity. We pushed for a bigger buyback mindset and a longer-dated capital allocation framework to anchor expectations.

- Incentives and transparency. Stock-based compensation was too high versus peers, and “it will drift down” isn’t a plan. We asked for a defined reduction path and clearer disclosure.

- Governance and accountability. We pushed for a stronger board: more independent, more relevant skills, better diversity, and (over time) the principle of separating Chairman and CEO. We were deliberate on sequencing - secure near-term wins before pushing the hardest changes.

- Compliance posture and sustainability. Not as marketing, but as risk management: credible targets grounded in what matters, linked to compensation, and a clearer narrative that the business is essential infrastructure.

And importantly, we judge engagement by outcomes - not by meetings.

Over 2024, we saw measurable movement: stock-based compensation expense fell 9% quarter-on-quarter, alongside explicit intent to keep reducing it; the company expanded its buyback authorisation and, by year end, repurchases executed amounted to roughly 3.5% of market capitalisation; and the board added an additional independent director. These aren’t headlines. They’re the basic mechanics that can lower a company’s discount rate if they keep going.

Across our China book, this is the standard. We run a simple engagement scoreboard: dilution trend, buyback execution, governance steps, disclosure upgrades, and compliance milestones. And we layer that into our proprietary Conviction Scorecard, which ranks fundamental upside and engagement upside - the strategy concentrates on the highest-conviction ideas where fixability is real, and shareholder-return potential is improved.

Change still takes time. The stock didn’t respond immediately. Sentiment rarely does. Other investors kept selling.

We stayed - not out of stubbornness, but because progress was becoming real and measurable. Over quarters, not weeks, the discount began to narrow as the evidence mounted. And sometimes it doesn’t work. If the scoreboard stops moving, or the risk becomes non-linear, we exit rather than argue ourselves into staying.

That is engagement: find what’s fixable, pick the levers that matter (in the right order), work with management, and hold through the lag between improvement and pricing.

Chart 4[6]: Engagement hotspot - the highest number of engagement points in the portfolio

Why China, why now?

Beijing is trying to rebalance: away from property-led growth and toward technology, advanced manufacturing, and consumption - with geopolitics setting harder limits than before.

The market increasingly prices “China” as a single risk factor. That’s the opportunity and the trap. The opportunity is dispersion: good businesses with fixable issues priced as if their problems are permanent. The trap is pretending engagement can fix what it can’t.

We can’t engage away geopolitics, sudden policy shocks, or the reality that state priorities can override minority shareholders. That’s why selectivity matters - and why sizing matters. We size China exposures assuming policy risk can gap and remain gap-prone, and we avoid situations that need policy predictability to work.

Our tripwires are explicit. We reassess our position quickly if: dilution stops improving for two consecutive quarters; buyback authorisations aren’t matched by execution over a reasonable period despite capacity; governance progress stalls for a year; or the compliance posture deteriorates in a way that makes the risk nonlinear.

Chart 5[7]:More engagement progress, more upside to surface

The path forward

As we enter the Year of the Horse, the challenges of China “the elephant” still loom large. Most investors still approach China like the blind men in the parable, confident in their impression, but guided by only a fraction of the whole.

It is vital to recognise that China cannot be understood by holding on to one datapoint or one narrative at a time. The scale, diversity, and internal contradictions that make it hard to grasp are the same features that make it systematically important.

References

[1] Countries with the largest gross domestic product (GDP) in 2025

[2] Understanding China through a fable shared by President Xi

[3] United Nations Industrial Development Organisation(UNIDO). National Accounts Database. Nov 2025

[4] Haver, Morgan Stanley Research estimates, as at 26.01.2026

[5&6] 6&7 GIB AM Analysis as at 09.02.2026.

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.