From adored to ignored: what's next for India?

Kunal Desai, CFA

Portfolio Manager

From adored to ignored: what's next for India?

Markets, like readers, often move on too quickly.

Earlier this year, a little-known Virginia Woolf manuscript written when she was just 25 was quietly published. Long overlooked, it found unexpected acclaim, not because it had changed, but because readers did. With time, its quiet precision became impossible to ignore.

For us, India feels similar.

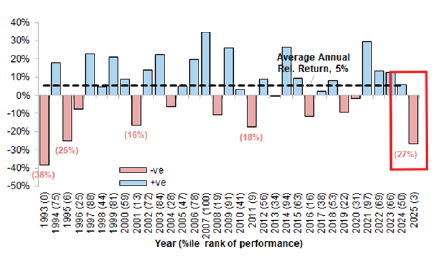

Until recently, the centrepiece of EM portfolios, it now sits on the sidelines. So far in 2025, it has delivered its weakest relative return to EM in over 30 years, underperforming the benchmark by 27 percent and landing in the bottom 3rd percentile of all years since 1993.

Chart 1[1]: MXIN vs. EM Rel. price return (USD, %)

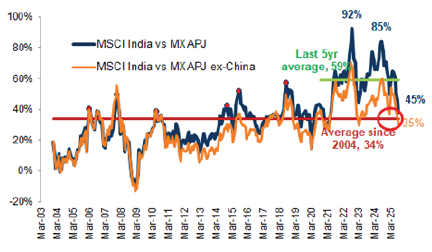

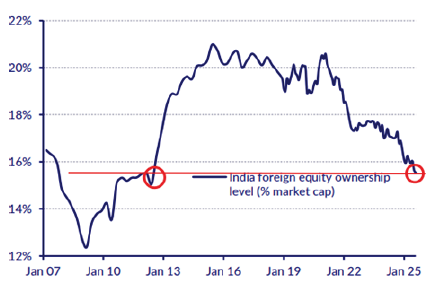

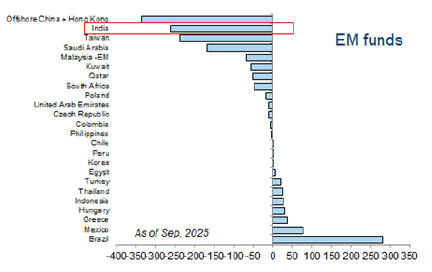

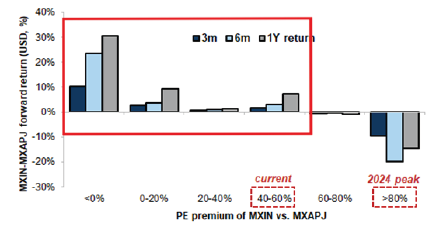

But the reversal hasn’t just been about relative returns. MSCI India’s valuation premium versus Asia has collapsed from a five-year high of 92% to just 45%, back to long-term averages. Foreign ownership has dropped to its lowest level since 2012. Among EM investors, India is now a consensus and sizeable underweight.

Portfolio engagement: CYIENT meeting in India

Chart 2[2]: NTM P/E premium/ discount since 2004: MXIN vs. MXAPJ

Chart 3[3]: India foreign equity ownership level (% market cap)

Chart 4[4]: Mutual fund OW/UW allocation (in bp)

Chart 5[5]: India PE premium and forward relative returns vs. MXAPJ: Median returns since 2004

The re-direction of flows has been dramatic. A near $22bn swing in foreign investor interest has pulled capital sharply towards AI-driven North Asia (China, Korea and Taiwan) at the expense of India.

Earlier in the year, we were tactically underweight. Valuations looked stretched, policy reform momentum had moderated post a fractured election and capex indicators were softening. Our concerns proved well founded.

The market has now re-priced the familiar out of fashion. We had agreed with the rationale, until now. As is often the case in markets, the consensus narrative has now run ahead of fundamentals.

Why India has always deserved its valuation premium

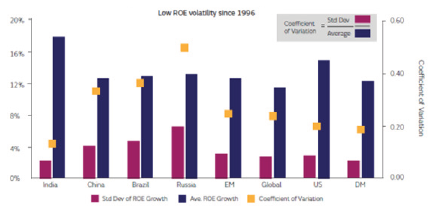

Despite being out of favour, India’s compounding strength has rarely looked more compelling. The market’s valuation premium versus peer markets is well deserved through the power of its predictable, consistent and high ROE growth.

Since 1996, the Indian market has been able to deliver consistently higher ROEs with superior predictability relative to competitor markets. India’s Coefficient of Variation: essentially the market’s volatility of ROE growth in the context of its size has trumped the delivery from alternative indices. Investors appreciate the compounding nature of cashflows harnessed by solid corporate fundamentals and their associated qualities.

Chart 6[6]: Why India deserves its valuation premium

Looking to the shorter term, corporate earnings are expected to accelerate from 11% to 14% CAGR through 2027. Over a three-year horizon, this places India at the top end of global earnings growth.

Return on Equity remains more than 5 percentage points above the EM average and the associated consistency of ROE delivery is unmatched. This is not a beta-driven bounce. It is structural.

On-the-ground engagement with portfolio companies

Where we see the most opportunity is in India’s mid-cap space. With PEG ratios at 1.1 times, compared to 1.5 times in large caps, quality growth is still priced reasonably. These companies also tend to be the most operationally geared to improving domestic conditions and are the primary beneficiaries of long-term capital compounding. Our Engagement focused approach of identifying sources of value unlock which are underappreciated by the market finds several compelling opportunities in this segment. As a result, our portfolio exposure is tilted here.

The market has discounted India as yesterday’s quality. We believe it is tomorrow’s compounder.

Where could we be wrong?

There are risks.

Continued preference for AI-linked growth can continue to dominate investor attention. If enthusiasm around infrastructure investment and application-layer development remains elevated, capital may stay concentrated in markets such as Korea, Taiwan and China, where companies are structurally embedded in the AI value chain. That said, with reasonable questions emerging about the durability of AI semi price action, how incremental global AI infrastructure capex intentions will be funded in light of historic levels of market concentration, any potential unwind can be to India’s relative advantage.

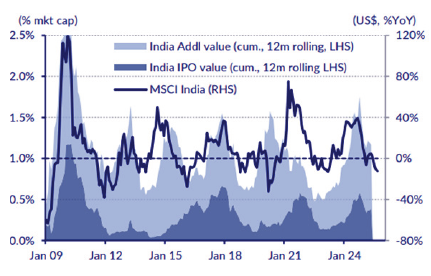

New equity issuance through IPOs, capital raises and owner stake sales has weighed on technicals. Historically, the Indian market peaks when issuance crosses 1.5% of market cap. We are already beyond that threshold.

Chart 7[7]: India total issuance* (% of market cap) versus equity market premium

Macro resilience is not immune either. A delayed global reflation or a resurgence of the US dollar could extend the outperformance of value-driven and commodity-linked markets. But India is relatively insulated, with a balanced current account, robust FX reserves and a central bank entering a rate cutting cycle from a position of strength.

Perhaps the most interesting risk is stylistic. India has been left behind in a market that rewarded cyclicality and multiple expansion. But that also sets the stage. As positioning reverts and attention returns to earnings delivery and capital discipline, India stands out. It is one of few EMs with the durability to match future expectations with realised returns. That used to be priced at a premium. Today, this has shrunk.

So what happens next?

India has experienced a full market cycle in little more than a year, moving from consensus favourite to apathetic neglect. Much of that shift was driven not by a deterioration in fundamentals, but by a change in narrative. Other stories, more speculative and more volatile, captured the market’s imagination. And so attention moved on.

But that rotation has left behind something rare. A market with accelerating earnings, improving macro data, embedded domestic flow support, and a credible policy backdrop, trading at levels that less reflects these strengths.

Earlier this year, a long-ignored Virginia Woolf manuscript found critical acclaim, not because it had changed, but because the audience had. India is now in a similar place. The underlying quality is intact. As the market cycle matures, we believe that recognition will return, not suddenly, but steadily.

This is a moment that rewards memory more than momentum.

References

[1] Bloomberg

[2] Goldman Sachs

[3] CLSA

[4] Goldman Sachs

[5] Goldman Sachs

[6] GIB AM

[7] CLSA, *IPOs + additional equity raise

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.