Emerging Markets outlook 2026: Strengthening fundamentals after a constructive 2025

Kunal Desai, CFA

Portfolio Manager

2025 in review

Executive summary 2025

Emerging Markets have recovered meaningfully. The next phase is likely to be driven by internal leadership rather than market direction:

- After a year dominated by liquidity, concentration and multiple expansion, earnings certainty, durability and return on equity (ROE) momentum offer opportunities;

- Valuation dispersion is attractive, with pockets of high-quality value emerging in underappreciated regions and subsectors despite strong economic moats and resilient earnings power;

- EM corporates are showing signs of stronger earnings revisions than Developed Markets.

2025 in review

What a difference a year makes.

Looking back at our Investment Letter notes from January 2025, the overriding mood was very different. Emerging Markets were still framed as yesterday’s trade: the “Lost Decade” narrative lingered and capital remained anchored to US exceptionalism. Positioning reflected this mindset with expectations low, and conviction lower still.

This uniformity of thinking was precisely what caught our attention. Market leadership, both in the US and in EM, was already narrow whilst valuations were stretched at the top end of the market with deep and indiscriminate pessimism elsewhere. History suggests that such conditions rarely persist indefinitely. They tend, as we argued, to create the preconditions for rotation.

That backdrop mattered. Over the course of 2025, Emerging Markets delivered a near 35% return in US dollar terms (the strongest year since 2017) outperforming the U.S. by roughly 17 percentage points. Returns were positive in every month of the year. More importantly, the path was healthier than many expected: EMs proved more resilient through periods of global volatility, with smaller drawdowns during tariff-related shocks or episodes of anxiety around AI exuberance, all whilst earnings expectations held up better than feared.

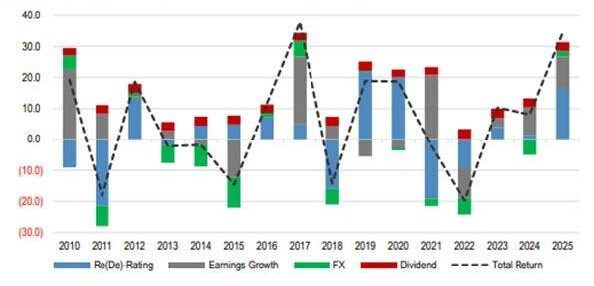

Chart 1[1]: MSCI EM annual return composition

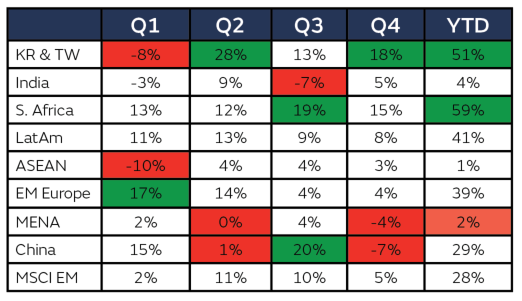

Unlike the US, where returns remain heavily concentrated in a handful of technology-focused names, EM performance was characterised by a series of rotations. Leadership shifted across regions and sectors, moving from China and Eastern Europe early in the year, through North Asia, South Africa and back again, reflecting a broader opportunity set than the market had initially priced.

Much of what we anticipated therefore rang true.

Chart 2[2]: Regional diversification within EM index: Leadership rotated across the year

The outlook for 2026

Looking ahead, the ingredients that supported EM performance in 2025 remain broadly in place, but the nature of the opportunity is evolving.

Fundamentals matter again. Growth differentials are stabilising, the U.S. dollar outlook is increasingly challenged and monetary policy across much of the EM universe is shifting towards easing.

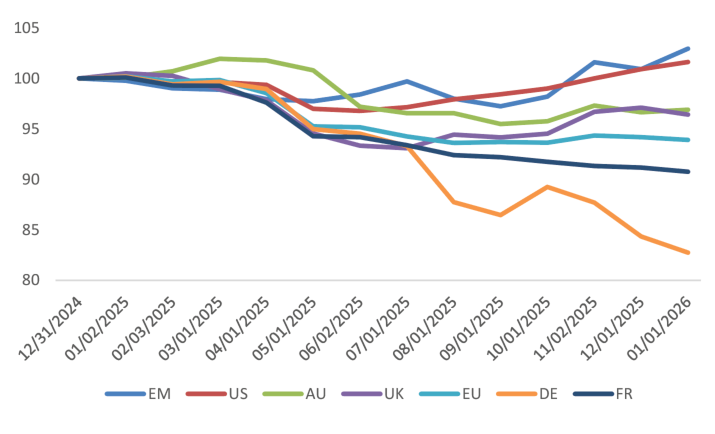

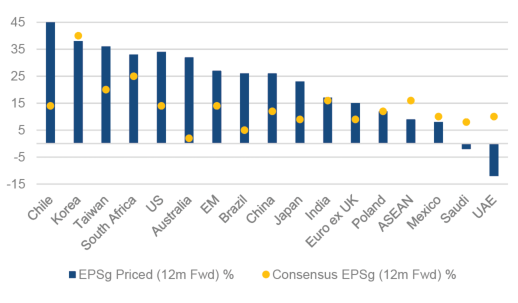

Consensus expectations now point to accelerating earnings growth, potentially rising from low-double-digits towards the high-teens, supported by improving return on equity (ROE) and greater earnings durability.

Chart 3[3]: Global regions - 26E EPS revisions

Valuations amplify this relative case. Emerging Markets trade below long-term averages, around 14x forward earnings, while the S&P 500 sits closer to 23x which is a level that places it deep into historical extremes.

This valuation gap does not on its own drive returns, but it does shape asymmetry.

Chart 4[4]: Deep value - compelling relative valuations

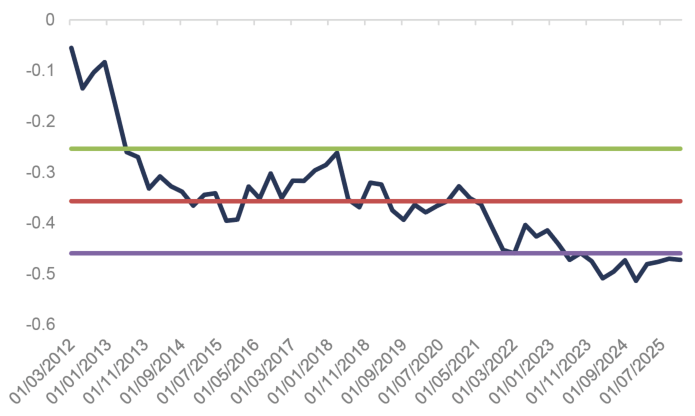

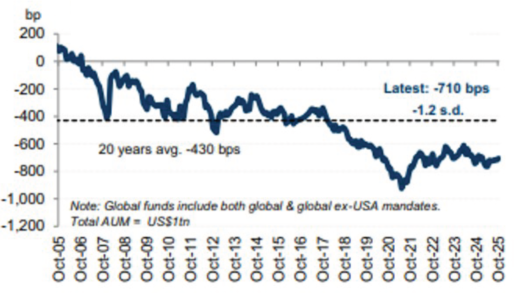

Positioning reinforces the point. Global active funds remain meaningfully underweight Emerging Markets (by roughly 700 basis points or more than one standard deviation below long-term norms) despite the strong performance of the past year. Capital has slowly begun to return, particularly outside China, but it remains far from crowded.

Chart 5[5]: EM's active allocation in global active funds (over/under-weight vs. MSCI benchmark)

The more interesting question for 2026 is therefore not whether Emerging Markets can deliver returns, but where leadership emerges.

After a year dominated by repricing and multiple expansion in a narrow set of stocks, the environment increasingly favours consistency of earnings, durability of cash flows and credible pathways to value creation. In a more multipolar world, that shifts attention towards areas such as:

- A gradual transition from AI infrastructure towards applications;

- Domestic self-sufficiency and economic security opportunities;

- The revival of domestic demand in under-appreciated, lagging markets;

- Rate-sensitive markets in Latin America and parts of CEEMEA benefiting from a turn in monetary cycles;

- Policy-driven value unlocks through governance and shareholder reform, and

- Companies that are “going global” from a position of balance-sheet strength.

Chart 6[6]: ''What's priced in'' for 12m Fwd EPS growth: EMs

Which brings us back to concentration.

Just as we are now beginning to see broader participation emerge in US markets, the risk-reward in Emerging Markets increasingly favours a widening of leadership. If that happens as history suggests it eventually will, the conditions become materially more supportive for strategies that prioritise differentiated positioning, high active share, engagement-driven stock selection and long-term

value creation over benchmark weight.

That, ultimately, is the debate we think matters most as we enter 2026.

References

[1] Bloomberg Finance L.P., IBES, J.P. Morgan; Price as at 31 December 2025

[2] Bloomberg as at 31 December 2025

[3] Citi Research, Factset, MSCI

[4] GIB AM Analysis

[5] Goldman Sachs

[6] FactSet, MSCI

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.