2026 Investment Themes

From AI infrastructure to business effectiveness

It’s the time of year for everyone to post their forecasts for 2026. Usually, we forget about these until about March when everyone starts making revisions. So rather than participate in this traditional investment rite, we prefer to think about themes and how they may or may not play out during the whole of the year.

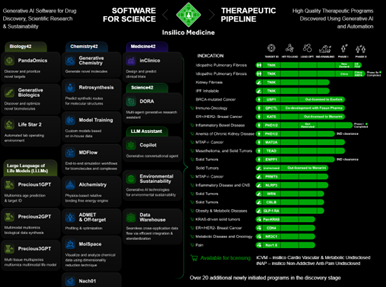

The investment hype of AI will switch from chip processing power to the business effectiveness of the use of AI. Over the last 3 years (since ChatGPT day) the focus has been on AI infrastructure, AI software and AI large language models. We expect this focus will shift from who gives us AI, to who uses AI. This will become particularly pertinent in those sectors where AI use will make a demonstrable financial difference. We already note the use of AI to solve the cost and efficiency challenges of pharmaceutical research and development. Dashboards such as Insilico Medicine will become the landing page for pharma and biotech rather than traditional (old-fashioned?) lifestyle images.

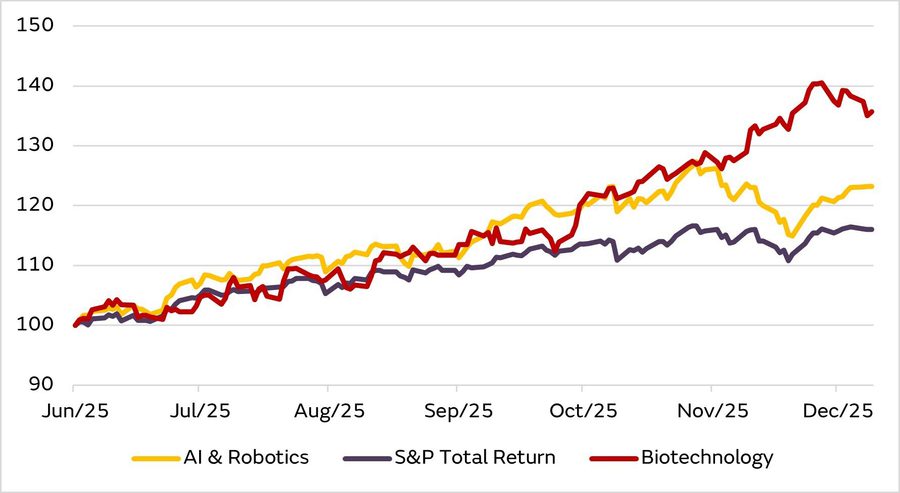

We note the rally in biotech stocks in recent months and the outperformance relative to AI and robotics and the broader market overall.

Chart 1[1]: From AI to BioTech

US tariffs will be an enabler for capital formation in the emerging markets. Those EM markets that, before tariffs, traded on labor cost advantages to produce cheap goods with little or no IP (t-shirts), will now be motivated to create actual equity added value in their domestic production with a renewed focus on capital goods.

The initial global reaction to US tariffs can be summarised as representing “a significant risk” to the global economy (Kristalina Georgieva, April 2025). Since then, views have moderated reflecting both the tempering of actual tariff rates and the fact that exporters have adjusted their business model; most emerging economies can “weather US tariffs without excessive pain” (Maplecroft, November 2025).

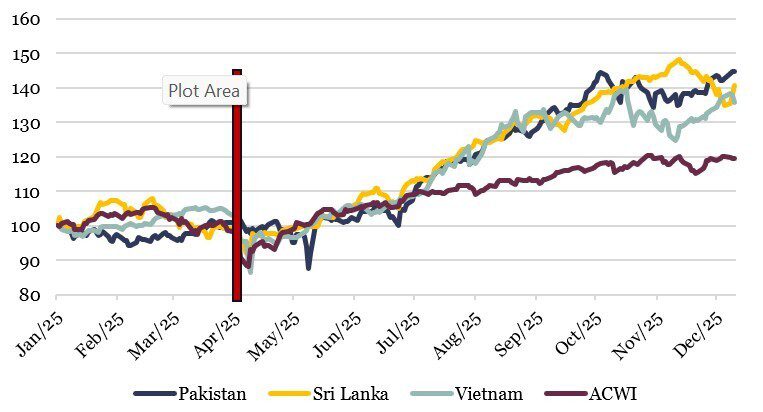

Chart 2[2]: Tarrifs

Certainly, investor reaction in those countries deemed to be particularly exposed to US tariffs has generated robust returns relative to the overall global market.

Chart 3[2]: Frontier markets and liberations day

For more on the potential broadening of investor appetite for EM, read here.

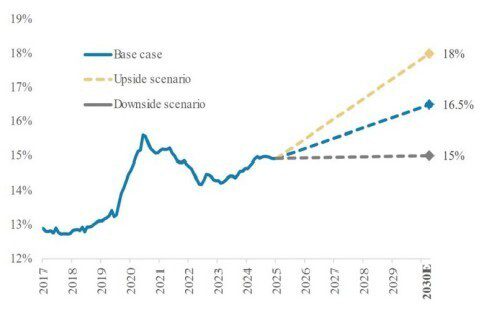

US corporate gross margins and Europe

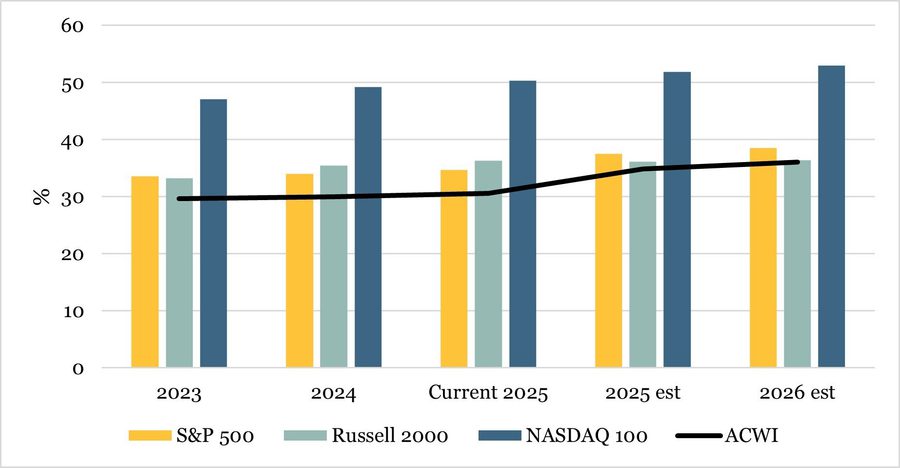

US corporate gross margins will continue to be able to absorb tariffs without passing them on to consumers in the form of capital goods inflation. US corporate gross margins have continued to expand across all cap categories (large cap, small cap and tech cap) and consensus forecasts suggest this will continue. Such gross margin resilience supports supply chain pricing power creating capacity for continued tariff-exposure inflation absorption.

Chart 4[3]: Gross margin

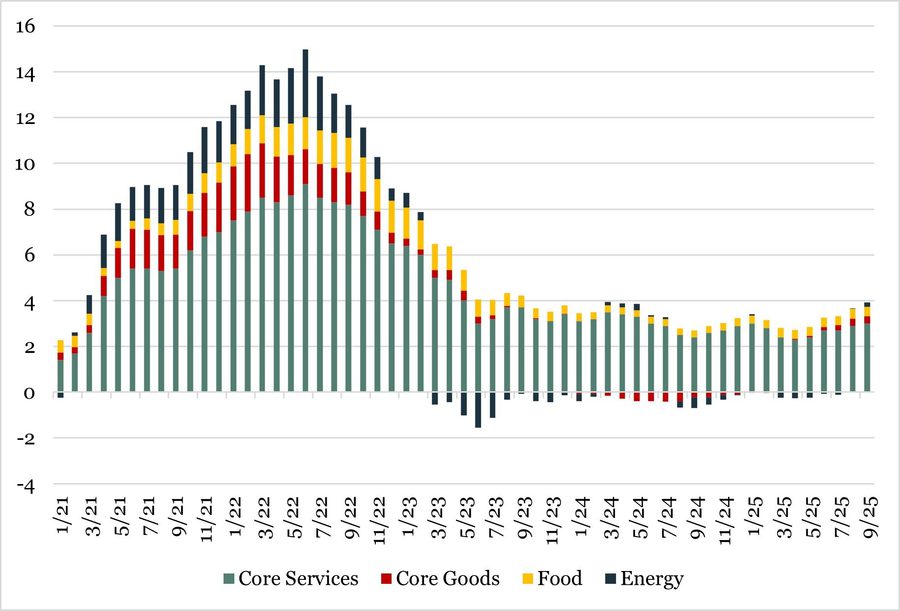

The components of core CPI inflation reflective of tariffs (core goods, food and energy) remained zero to negative for most of 2025.

Chart 5[3]: CPI core components

While these components merit a watchful eye, the combination of resilient gross margins and a business-friendly US administration inclined to be responsive to exemption requests, suggest muted inflation risk in the near term.

It will not be different in Europe this time. European entrepreneurship is mired in the DNA of European society and strong social safety nets will continue to have the opposite effect of the intent by effectively encouraging young ambitious Europeans to move to Dubai and the broader Gulf region.

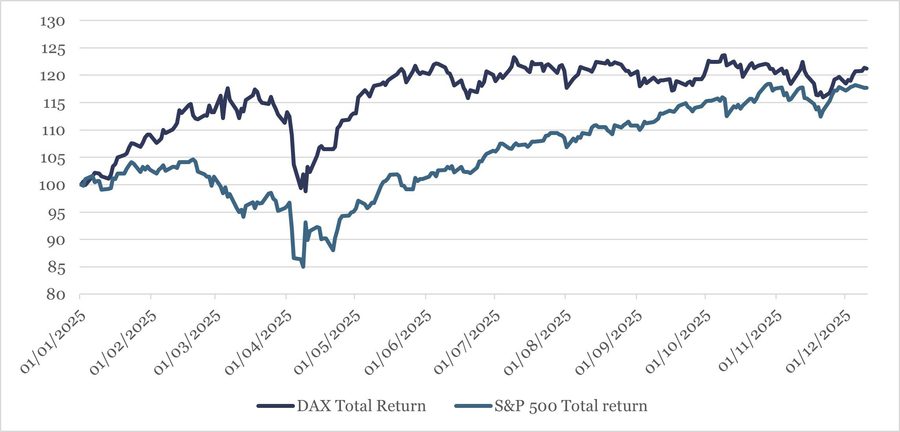

In the first half of 2025, there was much optimistic commentary that Europe would emerge with stronger economic growth on the back of easing energy prices and recovering household finances. In Germany in particular, there was an expectation of growth boosted by public sector investments in defense and infrastructure and much greater fiscal policy space. The reality, again, fell short of initial expectations; the initial rally of German equities against US equities only lasted the first half of the year with significant performance rotation back to the US at the time of writing.

Chart 6 [3]: German/US rotation

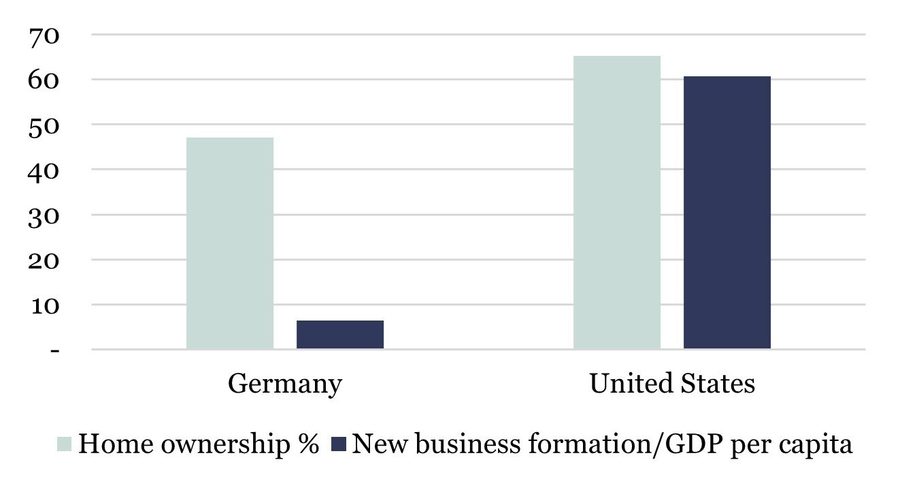

The harsh reality is that Europe cannot get out of its own way. The hopeful tone of the October 2024 Draghi report with its 383 recommendations for improved European competitiveness hit the brick wall of European bureaucracy with only 42 of the recommendations implemented a year later. The only way it can be different in Germany (and Germany is key to greater European performance) is a fundamental restructuring of economic society. Home ownership (the most basic component of equity wealth creation) is lower in Germany than the rest of Europe and much lower than in the US. No surprise then that new business formation relative to economic size and population lags miles behind the United States.

Chart 7[4]: Home ownership vs new businesses

Difficult to see the 6,700 or so European millionaire migrants to Dubai in 2024 returning home any time soon.

Japan

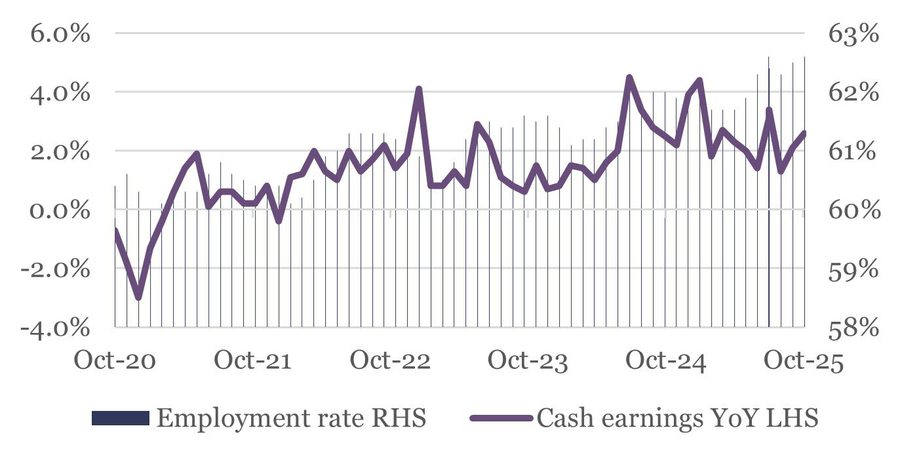

It will be different in Japan this time. The history of Japan’s various stimulus packages is a story of failure. The failure of the five stimulus packages from 1992 to 1999 caused the period to be known as the lost decade. Spending on public works and cash payouts simply did not reenergise what was then the second largest global economy. In 2026, expect global investors to learn a new word "Sanaenomics". These new fiscal and governance policies of the Sanae Takaichi administration are directed at the private sector that gainfully employs and pays Japanese consumers. Those employees are working longer (retirement age now at 65) and getting paid more. The second new word for global investors is “Rengo”, Japan’s largest trade union organisation, which is calling for a minimum 5% wage rise for 2026.

Chart 8[5]: More money to spend

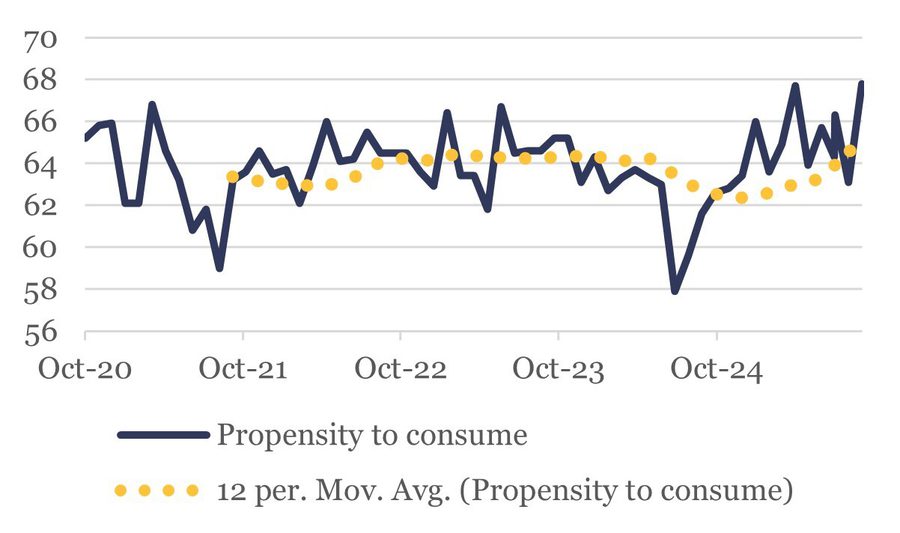

These reforms are designed to improve consumer confidence such that the Japanese propensity to consume actually has a chance to continue its recent positive momentum.

Chart 9[5]: Propensity to consume

Sanaenomics is the reminder that trying the same remedy for the same disease and expecting a different outcome is insanity. Trying something new has better odds. For example, the elimination of decades-old cross-shareholdings will finally allow Japanese corporates to be economically rational and focus on things like shareholder value rather than inter-corporate goodwill.

Middle East Vision and substantial FDI

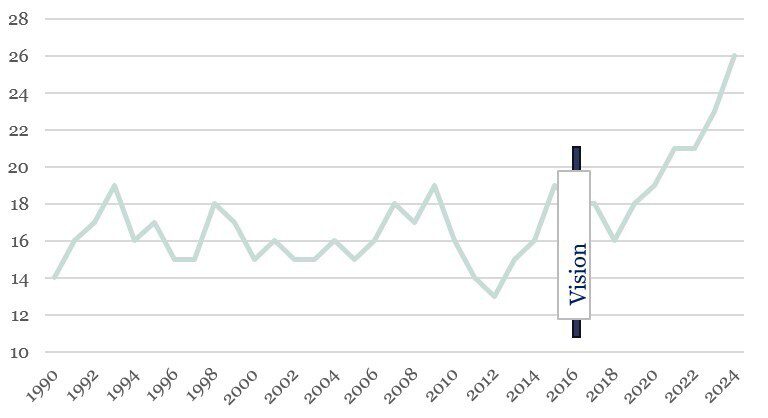

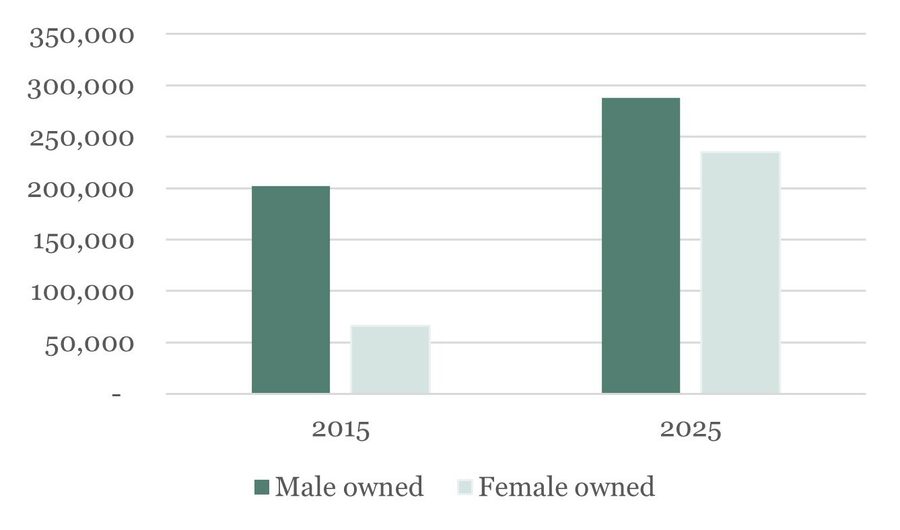

Middle East Vision plans will morph from ambition to pragmatism and unlock substantial FDI. Saudi Vision 2030 will be 10 years’ old in 2026. While Western media headlines will undoubtedly continue to focus on the progress or otherwise of a handful of mega projects, the reality is that Saudi Arabia specifically, and the Gulf more generally, has utterly transformed its domestic economy away from total reliance on the state to an ecosystem of thousands of young entrepreneurs (both male and female) eager to participate in Saudi economic activity.

Chart 10[6]: Gross fixed capital formation - Private sector % of GDP

During 2026, this momentum means the Gulf States Vision plans will move to their implementation phase becoming investible projects attracting hundreds of small and medium sized niche companies.

Chart 11[7]: New commercial registrations

This economic transformation provides a diverse operating and investment environment that moves the region away from a select handful of mega joint ventures with state-owned actors to an entrepreneurial framework capable of attracting global FDI in all shapes and sizes.

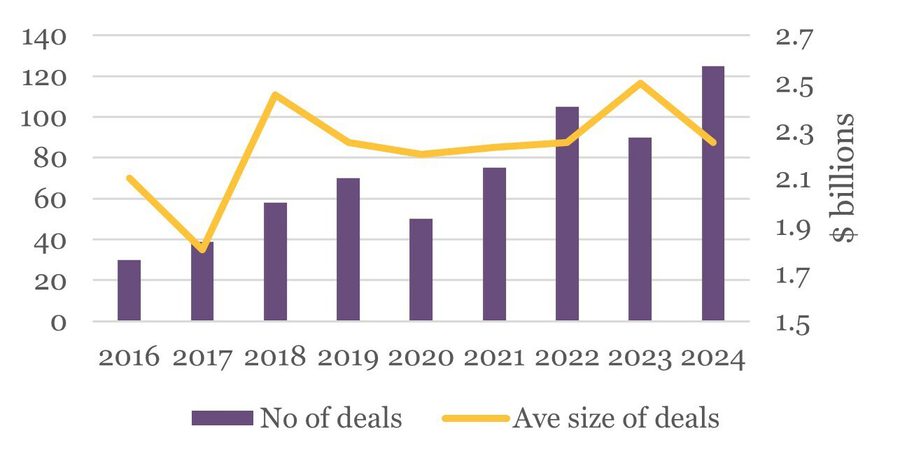

The SRT market will grow such that bank originated loans will fuel growth of the private credit market in the US and beyond. As regulators continue to lag the speed of bank deregulation relative to speed of demand for bank credit, banks turn to the SRT market for risk capital relief. This has been the case since 2023 when the Federal Reserve finally approved the use of SRT’s for US banks for risk weighted capital relief.

Thus, the impetus for market changing growth can be expected to come from the US while Europe will remain an important market.

Chart 12[8]: SRT transactions

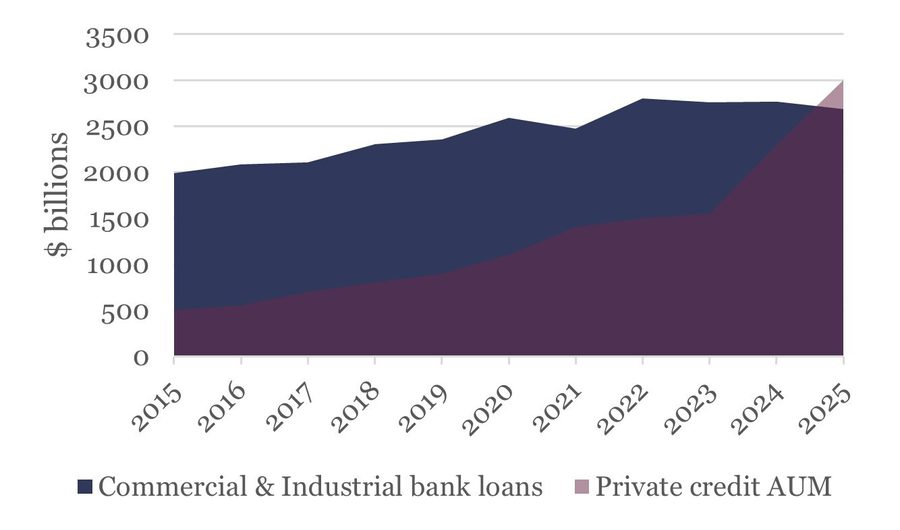

This of course is happening at the same time that the private credit market (the major buyer of SRTs) is turning the US bank market on its head.

Chart 13[9]: Commercial and industrial bank loans vs private credit AUM

On the assumption that bank originated loans are subject to greater credit committee scrutiny and diligence than by their private credit portfolio manager counterparts, we should expect the SRT market to accelerate the fueling of the private credit market. This will provide credit quality assurances for private credit investors looking for enhanced yield and longer duration. Banks are not yet redundant, but this structural change will lead to originate to distribute models and a focus on other revenue sources away from credit spreads. Bank regulators will increasingly need to understand retained (residual) risk and warehousing risk, something that was not well understood prior to the GFC. During 2026 central banks and regulators will increasingly need to balance political demands for credit led stimulus and bank system stability in a context where moral hazard isn’t a thing in the private credit markets.

References

Insilico Medicine

Pfizer

[1] Bloomberg, GIB Asset Management

[2] GIB Asset Management

[3] Bloomberg

[4] World Bank, GIB Asset Management

[5] Ministry of Health, Labour and Welfare

[6] World Bank

[7] Ministry of Commerce

[8] IMF

[9] FRED

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.