The second act of Emerging Markets

Kunal Desai, CFA

Portfolio Manager

The second act of Emerging Markets

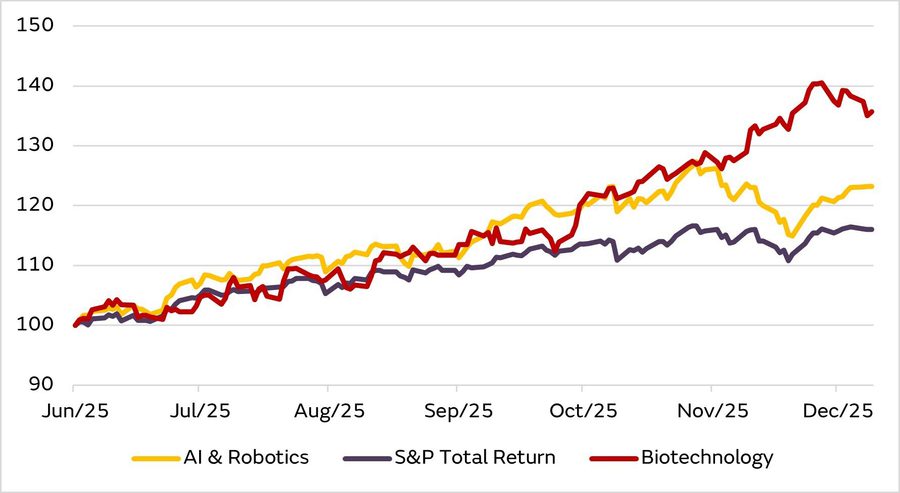

The second act in a movie franchise should remind the audience where the previous chapter concluded, update them on what’s happened since and excite them about what’s to come. This year’s rebound in Emerging Markets was the origin story, rekindling investors appreciation for the asset class. The next phase in the rally will hint at what might lie next. The initial rebound this year has been fast, broad and, in parts, surprisingly orderly. The cast of characters in the early stages of a recovery (South Korea, China and South Africa) have been front and centre, driven in part by strengthening narratives around the AI infrastructure build and associated metal price reflation, but also by a mechanical reversion from historically cheap valuations and under-owned positioning. This year has seen a repricing rally, with valuations buoyed by ample liquidity. The question for 2026: can EM’s leadership, not just sustain, but broaden from here?

Chart 1: A liquidity fuelled rally: more than 90% of global market capitalisation approaching all-time highs

Chart 2: The earnings reckoning is to come: 2025 equity returns broadly driven by re-rating

Much of the performance to date has come from the value end of EMs. Deep cyclical pockets such as Korean memory and Holdcos or South African and Chinese miners have re-rated on account of a penal expectations and generous liquidity. Meanwhile, markets typically associated with higher quality growth (India and parts of ASEAN) have lagged, pressured by premium valuations and lower sensitivity to AI-fuelled price action. India’s steady earnings story, which has broadened across consumption, capex and export categories, have delivered robust fundamentals but have failed to match the ‘bounce effect’ that powered the rally elsewhere.

India now offers a strangely contrarian opportunity with foreign ownership at 20-year lows, relative valuation premiums to Asia shrinking from 90% to sub 50%, and registering the weakest relative performance against the MSCI EM Index in 30 years.

Looking forward, the ingredients are in place for Emerging Markets to not only hold this year’s gains, but potentially to outpace Developed Markets. Earnings revisions are inflecting faster than in DMs for the first time in over a decade. Return on equity is recovering, with macro tailwinds building behind it. Most EM central banks are now easing into growth, not inflation. And perhaps most crucially, the USD, long the spoiler of EM bull markets, is rolling over at the same time as capital is beginning to rotate back into the asset class. As discussed before, the institutional changes we see developing in the U.S. have flipped the decades’ old mantra of “USD always a strong currency, unless proven otherwise” to the inverse. This trifecta of relative earnings momentum, monetary support and capital inflows is not only rare, but powerful!

But unlike the first half of the year, the second half won’t reward ‘cheap’ in isolation. We believe the liquidity-fuelled easy gains are largely over. From here, earnings power and consistent delivery will increasingly matter. Real earnings visibility, free cash flow power and Return on Equity (ROE) revisions. Geographies and sub sectors that struggle to move from hope to execution will struggle. This creates the potential for rotation: not away from EMs, but within them. This opens forgotten or lagging pockets of the market where fundamentals are strengthening under the surface. Indian capex plays, consumer durables and discretionary firms will likely see a second wind.

ASEAN consumer companies are beneficiaries of growing per capita demand and easing domestic policy. Meanwhile, even in countries which have performed well; China, South Korea and Brazil, we see new secular layers forming to fortify multi-year investment stories. The AI infrastructure buildout is driving self-sufficiency in the Chinese semi ecosystem. Korean HBM exports and K-beauty brands are gaining global market share. Taiwanese AI accelerators, Indian travel and consumption, and Brazilian private-sector leaders are emerging as quiet beneficiaries of a multi-polar world.

In other words, while EM’s first act was defined by relief and subsequent re-pricing, the sequel will be defined by earnings certainty and durability.

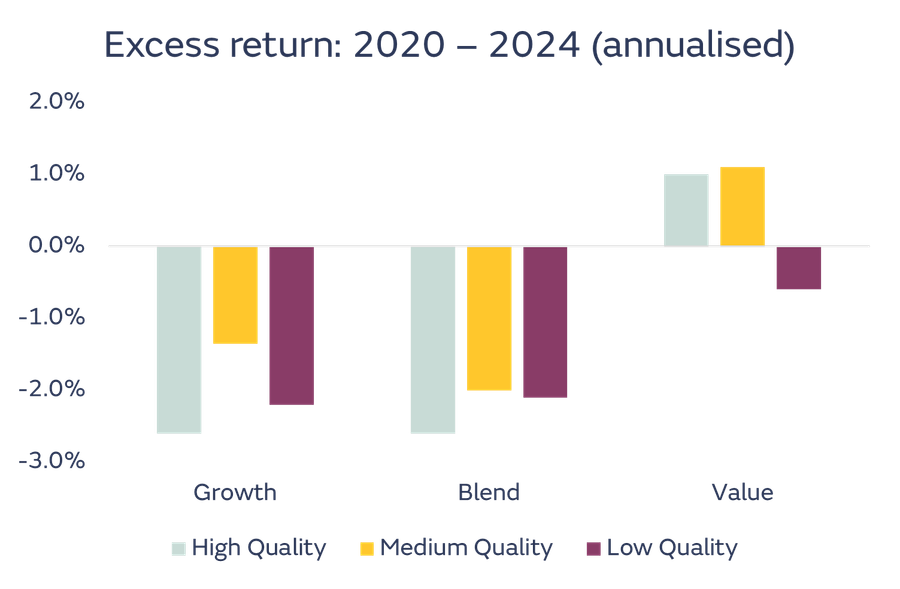

The great emerging markets style reversal - where next?

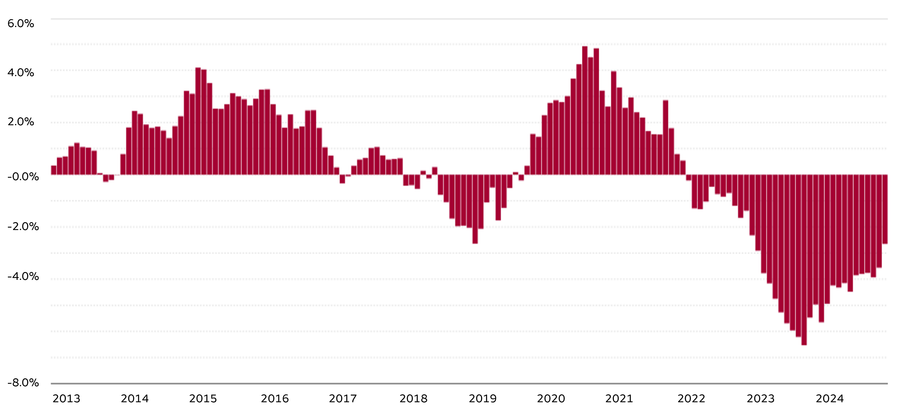

If the last cycle’s narrative was "buy Quality-Growth and sleep well," the last five years have been a rude awakening. What followed wasn’t just underperformance, but a systemic rejection of the Quality Growth style that had anchored portfolios for over a decade.

Chart 3: Growth investing was a winning card in Emerging Markets for a long time...until it wasn't

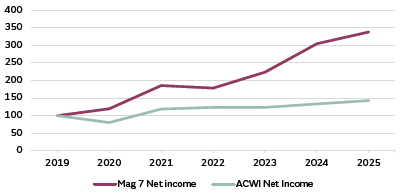

The numbers tell the story. Between 2019 and 2025, the median Quality Growth fund in Emerging Markets saw its probability of beating peers fall from 77% to just 33%. Assets under management in the category halved. Net outflows totalled USD 20.6 billion over that period. The once favoured strategy that had comfortably outperformed from 2010 to 2018 was not only out of favour, but was functionally abandoned.

Chart 4: A dramatic style reversal has more recently favoured Value factor

Chart 5: The rise and fall of Quality-Growth funds, but for how long?

1. Vanishing earnings growth

Quality Growth depends on earnings momentum. But EPS growth in EM, particularly in China, has all but vanished. The biggest disappointments came from companies previously deemed bulletproof: Chinese internet giants, consumer brands, and high-margin compounders. As earnings declined and deflationary forces stunted their ability to grow, the growth powered core of these funds disappeared.

2. Multiple compression

At the same time, portfolio companies suffered a sharp de-rating. Multiples fell as investors lost confidence in the sustainability of margins, particularly in China where real estate regulatory overhangs and demand fragility eroded sentiment. As Morningstar noted, “even when growth persisted, the P/E ratio shrank” gutting returns at both

ends of the value equation.

3. Mispriced ‘Quality’

Perhaps most damaging was the exposure of “Quality” businesses as less resilient than advertised. Many held up poorly in volatile markets, especially in China, where firms with high perceived defensiveness crumbled under weak demand and regulatory heat. The style’s perceived margin of safety turned out to be a mirage in too many cases.

Overlaying all of this was positioning risk: Quality Growth funds were underweight high-dividend SOEs, which acted as a relative safe haven, and overweight long duration, low-yield tech and consumer names most exposed to valuation and growth downgrades.

So, can this change? And why now?

We think so. And not because the market owes growth anything, but rather because the conditions for recovery are aligning:

Earnings inflection is underway: AI infrastructure, automation, and targeted stimulus in China are supporting pockets of earnings recovery. Taiwan and South Korea are seeing margin rebuilds in high-performance tech. India’s capex cycle and consumer resilience are backstopping growth.

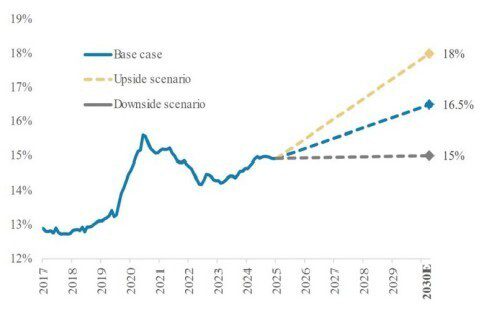

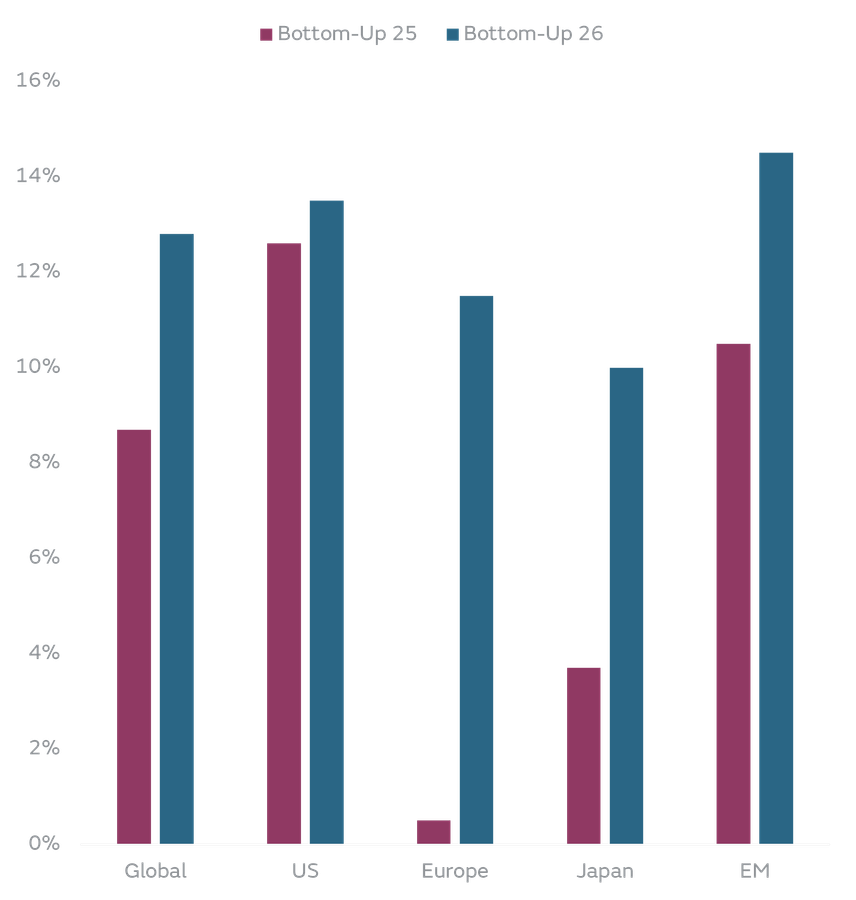

Chart 7: EM mid cap to see the fastest pick up in earnings growth globally

Valuations are no longer stretched: Many high-quality franchises now trade at valuation levels not seen since 2015–16, a period that presaged one of the strongest relative runs for the style. Rarely are the best businesses also among the cheapest. This may be one of those moments.

Chart 8: Once expensive – but no longer: Quality factor has de-rated to attractive levels

Chart 9: History points to the dominance of Quality factor in Emerging Asia

Policy backdrop is shifting: The EM rate cycle is easing. China’s renewed focus on capital return, margin discipline and industrial policy coordination creates a more credible earnings narrative. We see regulators pushing for fewer profitless growth stories and more actual profitability.

Sentiment and flows remain low: Ownership of Quality Growth remains depressed, which provides runway. A re-rating could be sharp if earnings beat and positive surprises return, something we've already started to see in sectors like AI semis, export tech, and capital discipline stories in India and South Korea.

Chart 10: As the EM recovery broadens and matures, Growth, Revision and Quality factors will matter even more

In short: Value has led, but the pendulum is likely to swing back. Quality Growth doesn’t need the liquidity tsunami of 2020 to return. As we move to a different rate regime, it just needs the importance of earnings compounding to matter more. In a market where investors are placing more emphasis on delivery than discount, we see fertile ground for an evolution of such style leadership.

Reference List & Disclaimers

(1)(2) FactSet, MSCI, Goldman Sachs Global Investment Research

(3-5) Morningstar, 2025

(6) Citi, 2025

(7)(8) NBS, MoF, Bloomberg, Goldman Sachs, Macquarie, MSCI China & GIB AM analysis 2025

(9) CLSA

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.

Read moreThis content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.