Value unlock! How active engagement can make a difference

Megan Ie

Senior Equity Analyst

Greg Konieczny

Head of Global Emerging Markets Equities

Kunal Desai, CFA

Portfolio Manager

Marcin Lewczuk, CFA

Portfolio Manager

Engagement action points

Turning back to this quarter, we have seen some important engagement outcomes materialising to drive portfolio returns. Our engagement process with companies is typically a 36-month process and begins prior to our point of initial investment. We believe that each incremental step compounds to help drive the wider company transformation. We have outlined some highlights below:

One of our portfolio companies, a leading Chinese online recruitment platform, has faced significant market pressure due to deteriorating macroeconomic conditions in China and their implications for its business outlook. We have recommended several improvements to the company, including addressing excessive stock-based compensation and the lack of a granular framework for performance evaluation through key performance indicators (KPIs). Moreover, we believe that during times of increased market volatility and share price pressure, companies with substantial net cash reserves should proactively revisit their capital allocation policies and consider introducing an upsized buyback program. We are confident that rectifying these issues will immediately enhance shareholder returns and strengthen market perceptions of the company’s governance practices.

Another portfolio company, a leading Chinese online travel service provider, experienced prolonged share price weakness throughout 2024, driven by challenging market conditions and subdued domestic travel demand. Despite a buyback program in place, which repurchased approximately 6 million shares in 2024, we identified further potential for capital returns, given the company’s strong cash reserves. Our engagement emphasized the benefits of expanding the buyback program to enhance longterm compounding value. Consequently, the company announced plans for an expanded capital return program for 2025, pending board approval.

A Chinese food retailer in our portfolio has also faced valuation pressures due to weak domestic consumption. Our engagement focused on encouraging the company to accelerate and scale its franchising business, which, given its asset-light nature, has the potential to significantly improve return on invested capital (ROIC). Over time, this strategy can unlock shareholder value by enabling greater scalability and improving profitability, likely triggering a positive re-rating of the company’s valuation. Following our recommendations, the company has increased its focus on franchising and has communicated the long-term benefits of this strategy to stakeholders

In Saudi Arabia, a gym operator in our portfolio lagged peers in implementing sustainability initiatives. Our engagement outlined a three-step sustainability framework, beginning with a materiality survey to assess key environmental, social, and governance (ESG) issues among shareholders. Addressing these sustainability priorities can lower the company’s implied cost of capital, attract sustainability-focused investors, and diversify the shareholder base. Following our engagement, the company initiated a materiality assessment to identify and address critical ESG concerns, marking a significant step forward in its sustainability journey.

Sustainability engagement at a portfolio level

Our portfolio companies have demonstrated a strong commitment to advancing governance and sustainability practices, consistently outperforming the MSCI Emerging Markets Index on key engagement metrics. Since the inception of our fund, we have actively engaged with portfolio companies, driving significant achievements in board independence, diversity, sustainability, and capital allocation.

Board Independence

A key focus has been increasing the independence of boards of directors. Since our fund's launch, 13 of our portfolio companies, representing 28%, have enhanced their board independence. This helped bring the average Board independence ratio of the portfolio to 54.4% vs. 44.7% average for the benchmark. This improvement in board composition has led to better oversight, accountability, and more robust decision-making processes. Notably, three of our portfolio companies have exceeded the 50% board independence threshold, reflecting a commitment to strong governance practices and the importance of independent boards providing unbiased guidance and oversight

Diversity

Diversity on boards is critical for fostering varied perspectives and inclusive decision-making. Our proactive engagement has driven significant progress in this area, with 35% of our portfolio companies, increasing the share of female representation on their boards. As a result of this improvement the average female board participation for the portfolio increased to 19.35 vs 17.1% for the benchmark. This commitment to gender diversity underscores the positive impact of our engagement on governance practices.

Sustainability

Following our Net Zero engagement, 20% of portfolio holdings have introduced SBTI net zero targets, showcasing a dedication to sustainable practice

Capital Allocation

Additionally, 32% of portfolio companies increased their dividend payout ratio during our investment period, reflecting a more focused and enhanced approach to capital allocation.

These efforts have not only improved corporate governance, sustainability, and capital allocation but have also contributed to the enhanced ESG ratings of our portfolio companies. During this period, 33% of our holdings have registered MSCI ESG ratings upgrades, with 15% achieving at least a double upgrade. While our primary engagement goal is not to improve ESG ratings, we believe these improvements can significantly help companies reduce their implied cost of capital, ultimately serving as a source of return for our fund.

These achievements highlight our dedication to active management, reinforcing shareholder returns through purposeful and sustained engagement.

Our engagement outlook ahead

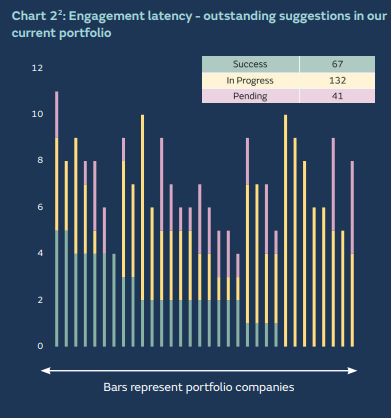

We are particularly excited about the inbuilt latency that exists in the portfolio today. We were successful with 67 Engagement Action Points since inception with each having an impact on improving the Compounding Power or reducing the market implied Cost of Capital for their respective business.

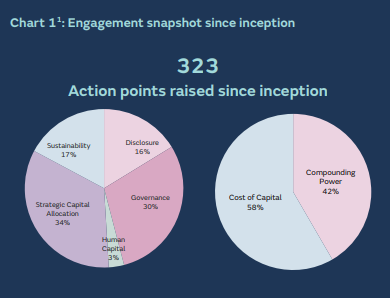

Looking ahead, there remain 173 outstanding Action Points across the portfolio, which we believe can help drive future incremental returns. Of these Action Points, 58% are focused on reducing the market implied Cost of Capital whilst 42% aim on improving the business’ Compounding Power. 30% of our Action Points center on improving Governance; 34% on Strategic Capital Allocation; 17% on incorporating Sustainability as a source of returns, 16% on improved Disclosure and 3% on material improvements in Human Capital

The chart bellows illustrates the remaining Action Points we have for our 34 companies in the portfolio. 66 Action Points have been successfully resolved (shaded green) however, the yellow and purple shaded areas point to the outstanding unresolved Action Points that represent unaccounted inbuilt latency

As these bars turn incrementally green over the subsequent months and years ahead, this can be a strong predictor of future shareholder returns to come.

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.