Don't look back in anger: the recovery and rise of Emerging Markets

Kunal Desai, CFA

Portfolio Manager

Getting the band back together: what Oasis can teach us

As Emerging Markets specialists, we often (perhaps wrongly!) believe our arena to be the only game in town. But as the summer gears up, there’s a hotter prospect on the horizon. Oasis – after sixteen fallow years – return for one of the most widely anticipated comeback tours in music history. Will their return be a flash in a pan, or something altogether more long lasting. These are the questions we’ve been asking ourselves as market leadership rotates sharply away from the U.S. to international assets.

In 2009, Emerging Markets equities and Oasis shared a high-water mark. That year, the asset class outpaced its U.S. peers, buoyed by accelerating growth and ample liquidity, whilst Oasis performed one last time before an extended hiatus. Since then, both have endured something of a post-party malaise. Emerging Markets have languished under periods of balance sheet repair, capital outflows and investor scepticism. Meanwhile, Noel and Liam Gallagher’s relationship has resembled a badly managed sovereign default: enduring tension, occasional brinkmanship and no clear resolution.

Fast-forward to 2025. Emerging Markets are outpacing U.S. stocks by nine percentage points YTD. Flows are accelerating. The catalysts are familiar: a return to fiscal policy orthodoxy, stronger balance sheets, an earnings revision cycle and a dramatic decline in the U.S. dollar. Corporates have de-levered. Governments have embraced reform. Growth is no longer a function of easy liquidity alone but of better governance and competitive industries. The asset class has, in effect, grown up.

At the same time, Oasis are back together, mending fences and rehashing old hits for eager crowds. The reconciliation tour, billed as a one-off, feels like a test run for something more enduring. Just as fans wonder whether Liam’s swagger and Noel’s riffs can coexist beyond the nostalgic encore, investors must ask if Emerging Markets can sustain this revival without slipping back into old habits.

Both stories are at a crossroads. The band has reconciled its creative differences, but only time will tell whether new chemistry emerges. The asset class has addressed its imbalances, but the global economic stage remains fickle.

As Oasis tune up for their comeback, perhaps the more pertinent question is whether Emerging Markets have returned in a more meaningful and sustained way.

Is this time different? Definitely, Maybe.

Market review & outlook: what surprised us, what didn't & where next?

Global stocks sank 10-15% after President Trump announced higher-than-expected reciprocal tariffs on most trade partners on 02 April. Markets rebounded quickly with signs of de-escalation, and surged even higher than the 02 April levels following the US-China trade truce in May and June. We saw further rallies after the Iran-Israel ceasefire. USD depreciated in Q2 25, down 6.7%, to the lowest level since March 2022. Emerging Markets (+12.2%) outperformed the US (+10.6%) despite both asset classes achieving strong absolute returns. Within Emerging Markets, South Korea (+32.6%), Taiwan (+26.4%) and Mexico (+20.8%) led, whilst Saudi Arabia (-5.0%), China (+2.6%) and Turkey (+3.1%) lagged.

At the halfway stage of 2025, Emerging Markets have performed strongly with outperformance versus the U.S. market stretching to 9 percentage points. This represents the widest relative outperformance seen in eight years. It’s clear that global allocators are beginning to take note with the reappraisal of Emerging Markets’ investment case now moving to the top of many priority lists.

The end of dollar dominance: what this can mean for Emerging Markets

Over the past six months, markets have weathered a string of US-centric shocks— from trade war chaos to debt-ceiling brinkmanship. More recently, Federal Reserve caution and last-minute fiscal deals have eased the threat of outright panic. But the damage is done: foreign-exchange traders have attached fresh risk premia on the dollar, triggering one of its sharpest deratings since the 1970s.

That shift matters. Investors no longer assume the dollar’s strength as a given. The old mantra, “strong unless proven weak”, has been replaced by its inverse. This reversal reflects growing doubts about American exceptionalism. Political brinkmanship, eroding institutional trust and waning diplomatic clout have all diminished confidence in US growth and returns.

With the “insanity premium*” on dollar assets beginning to recede, any further slide may slow—and even allow a short-term rebound. Yet medium-term headwinds remain. A still richly valued US dollar, paired with domestic policy uncertainty, is unlikely to reclaim its former dominance.

For Emerging Markets, this backdrop is compelling. A softer dollar lowers the cost of servicing dollar-denominated debt, eases refinancing risks and boosts corporate margins. Local currencies, undervalued after years of dollar strength, have room to recover, enhancing total returns. Meanwhile, central banks in many EM economies retain more policy flexibility than their advanced-economy counterparts, allowing them to support growth without stoking runaway inflation.

Yield differentials also favour a tilt toward EM. Real returns on sovereign and corporate bonds in Asia, Latin America and parts of Eastern Europe outpace those in the US. Equities in many emerging markets trade at discounts to their historical averages, despite stronger fundamentals and faster growth trajectories.

Finally, diversification into EM offers a hedge against US-specific risks. With global capital markets increasingly intertwined, reducing concentration in US assets can improve portfolio resilience. For investors seeking both income and growth, the combination of cheaper funding costs, attractive valuations and brighter growth prospects makes Emerging Markets hard to ignore.

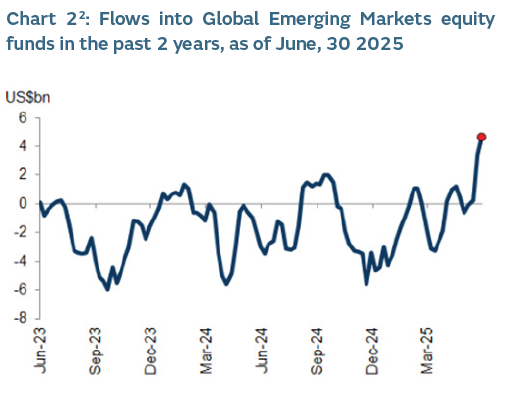

EM equity flows are undergoing a structural shift, with geopolitical frictions and trade disputes feeding into an "anti-America" narrative that encourages international investors to repatriate capital. U.S. equity holdings by foreign investors are at all-time highs of 18%, and a reversion to pre-pandemic levels of 15% could trigger up to $1.7 trillion in outflows. A combination of "push" factors from U.S. policy uncertainty and "pull" factors from attractive EM fundamentals may redirect this capital toward Emerging Markets. We are now beginning to see this come through. Allocations towards Global Emerging Markets equity funds are inflecting, with June registering the strongest rolling monthly flows in several years.

In a world where the dollar’s assumed supremacy is under question, reallocating toward emerging markets isn’t just an alternative - it’s a strategic imperative.

*”Is there an insanity premium on interest rates?” Paul Krugman (2025)

Engagement action points update

Turning back to this quarter, some important engagement outcomes have materialised to drive portfolio returns. Our engagement with companies is typically a 36-month process and begins prior to our point of initial investment. We believe that each incremental step compounds to help drive the wider company transformation. We have outlined some highlights below:

One of our portfolio companies, an Indian industrials player, faced share price weakness amid market concerns over a new entrant and potential subsequent supply overcapacity. Following our engagement over 2024 and 2025, the company delivered a step-change in progress this quarter. Our engagement proposed targeted initiatives on margin enhancement through R&D investments into high voltage segments, working capital unlock, accelerated governance reform, and articulating a long-term strategic vision. These areas we believed were critical to unlocking value and trigger a reassessment by the market. Several of these Engagement Action Points were introduced in the company’s quarterly results, which catalysed a sharp market reaction: rallying 15% with analysts pointing to management’s proactive stance. Key actions included the aforementioned pivot toward high-voltage products, the launch of a three-year corporate vision, and the adoption of working capital efficiency as a core KPI. Additionally, the subsequent appointment of an independent non-executive chairman and next-generation executive directors addressed long-standing governance and succession concerns, resulting in a further 9% appreciation in the share price. The market’s positive response underscores growing confidence in the company’s strategy and governance, an outcome that attests to the material impact of our bespoke engagement.

A South Korean consumer staples holding, also experienced a notable re-rating this quarter, following earlier concerns around its go-to-market strategy and inadequate sell-side coverage, factors that had kept expectations muted despite solid underlying fundamentals. We met with the company in late 2024 to present a set of strategic proposals addressing our concerns. These included a shift in focus towards business-to-business opportunities, pivoting towards margin-accretive growth and encouraging regulatory oversight; accelerating global export opportunities through asset-light distribution and in-market partnerships; addressing brand equity and product quality concerns through dedicated resourcing; and hosting an Investor Day alongside broader communication efforts to ignite foreign institutional investor interest.

We were pleased to see many of these recommendations introduced in their latest quarterly results. Management have taken decisive steps aligned with these priorities, announcing a strategic pivot toward B2B alongside highlighting exports as a key focal point of its near term expected success. Further to this, a new team have been appointed to address brand equity and product quality deficiencies. The company also committed to hosting its first Investor Day and expanded its communications to include English-language disclosures, which will be instrumental to attract broader institutional investor interest. This marks meaningful progress on the points we raised during our engagement. The stock rose 29% following the release, with the news acting as a catalyst for a positive and unexpected shift in expectations in the company's ability to compound and protect returns. This is exactly the kind of outcome our engagement is designed to achieve. Over the course of the quarter, their shares rose over 150%.

A Taiwanese semiconductor holding, also saw a reappraisal by the market this quarter, following concerns around its strategic positioning in AI infrastructure and the strength of its governance framework. We previously met with management to present a focused set of engagement priorities. Chief among them was the need to address the company’s lack of proprietary server-related IP, an area we identified as a structural weakness. We encouraged the pursuit of targeted M&A or strategic alliances to close this gap. We also highlighted the importance of transitioning to a majority-independent board to enhance governance credibility. Since then, the company has appointed four new independent directors at the May 2025 AGM, shifting the board to a majority-independent structure. It subsequently also announced a strategic partnership to co-develop connectivity IP for AI servers, an important milestone that directly aligns with our recommendations. The stock price reacted accordingly, as with the previous two cases, rising 7% on the day of the announcement, further exemplifying the value bespoke engagement can add within emerging markets. This further exemplifies the value bespoke engagement can contribute within Emerging Markets.

In parallel to the above, we continue to see encouraging engagement progress across the portfolio, with particularly meaningful developments emerging in key pockets within China and South Korea. From strengthened board governance to the initiation of new share buyback programs on the quarter, our dialogue with management teams continues to drive material value creation and performance across the portfolio.

References

1. The Capital Spectator: Macro Briefing:1 July 2025

2. EPFR, Goldman Sachs Global Investment Research

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.

Imagery: wallpapers.com