They went hard, then they went home - The state of play for banking climate targets in 2025

Alexander Latter, CFA

Credit Analyst

The state of play for banking climate targets in 2025

In this note we examine the recent evolution of climate targets in the financial sector. We look at the path taken to date and what direction firms and investors are likely to go in the context of a US administration that is hostile to environmental reforms. We draw insight from our engagements with investors and bank management teams: ultimately with the conclusions that it is imperative for analysts to take a holistic view of each company’s impact from – and commitment to – such sustainability initiatives.

In the early days, to understand a bank’s sustainability credentials, analysts had to pour over lengthy annual reports to glean initiatives and commitment to this space. The lengthy reports haven’t gone away, however things have changed in terms of greater strategic sustainability transparency. The period from 2021 to 2023 marked a time of high ambition for the sustainability departments of banks and financial firms; management teams clambered over each other to be the most ambitions, the most committed and the most green. At the same time, a series of high profile industry bodies were established, introducing complicated financed emissions targets.

However, as rates – and bank share prices - rose, more traditional priorities such as deposit margins, credit losses and shareholder payouts returned to focus. At the same time investors, particularly in the US, began to lose their fervour for ambitious climate strategies. Legislators in Republican states began to mutter darkly about fiduciary duty (1) and industry collusion (2).

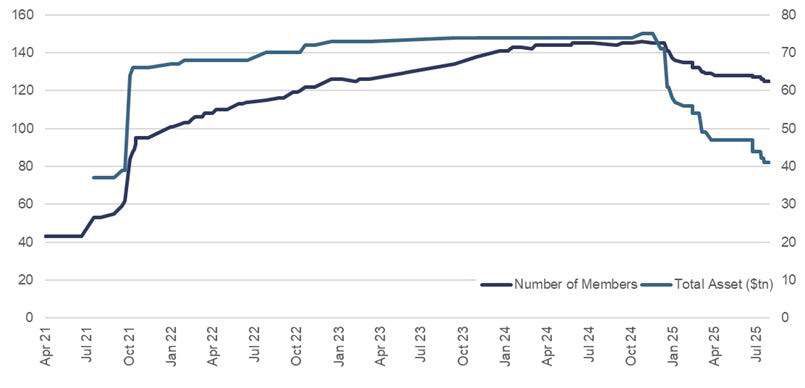

Slowly, and then all at once, institutions began shuffling towards the exit. The Net Zero Insurance Alliance went first (3), then the Net Zero Asset Managers Initiative (4) put itself on hiatus. Finally, with the accession of the Trump administration, the Net Zero Banking Alliance (NZBA) saw its North American members hit the ejector button (5). Japanese (6) and some Australian (7) banks have followed.

Eventually, under significant pressure from remaining members, the NZBA folded and watered down its targets (8), dropping its requirement for banks to align targets with a 1.5°C warming scenario, replacing it with a recommendation that they target ‘well below 2°C’.

This shift has failed to staunch the flow of departures, with two UK banks (9) and UBS (10) subsequently choosing to leave the alliance citing the reduced membership and its reduced usefulness for global banks. In some cases where banks have remained members, boards have quietly refreshed management incentives and downgraded top sustainability positions.

In the EU, firms have generally held the line although there are rumblings beneath the surface. It would not be a huge surprise to see more internationally active banks resign their memberships leaving NZBA membership concentrated in national retail banks but without the wide ranging corporate finance banks which provide the bulk of financing to high emission sectors such as Oil & Gas extraction.

Chart 1: Net-Zero Banking Alliance members (11)

Conversations with the leavers

GIB AM has engaged with four of the six largest US banks that triggered the exodus from the NZBA to understand their motivations for doing so and next steps. We have also reached out to the large European banks that have exited the alliance. All the institutions we spoke to explained that they remained committed to executing on their climate transition but that they had enough expertise in house to track progress and no longer required assistance from organisations such as the NZBA. They pointed to the fact that the targets set under the NZBA in addition to various green and climate-related new business targets remained in place. However, they conceded that, the desire to avoid anti-trust and state level litigation and the changing political environment in the US were contributing factors to leaving the NZBA.

It is hard to escape the additional conclusion that this green-hushing is also motivated by the fact that a more accommodative policy stance towards Oil & Gas investment will open additional financing opportunities for banks, which may otherwise find their hands tied by restrictive climate targets. Following our initial engagement, one bank subsequently dropped its targets entirely. Follow up discussions suggested that a combination of legal risk management and a desire not to restrict profitable business lines in the pursuit of ambitious targets were the key drivers (12). A notable feature of the second wave of resignations is that several banks have explicitly cited the diminished relevance of the NZBA for global corporate banks following the departure of the six largest US institutions. While not all banks have taken this path—Standard Chartered, for example, has reaffirmed its commitment to net zero, albeit without explicitly endorsing the NZBA - it is possible that this could offer a rationale for further exits, especially for large EU players.

What next for sustainability investors

One very reasonable criticism of financed emissions targets is that climate commitments depend largely on the assumption that the wider economy will eventually decarbonise, enabling banks to reach their targets. As a result, it should be no surprise that targets are being walked back in line with the policy environment. In addition, academic research has found limited evidence that making net zero commitments actually results in material changes in lender or borrowe behaviour (13).

Falling NZBA membership has made comparing banks sustainability practices significantly harder, as well as increasing the likelihood of different firms and regions using divergent methodologies and disclosures. As a result, fully understanding a bank’s underlying commitments and progress on sustainability is increasingly important. Financed emissions targets will remain an important sign of intent but focus is likely to turn to the various new business targets published by banks as well as more externally verifiable measures of financing activity. One headline measure of a bank’s contribution to sustainability is the volume of ‘sustainable financing’. Most banks have committed to large sums of business that they consider to be promoting sustainability; Barclays and HSBC have each committed to $1tn of sustainable investment by 2030, NatWest targets £100bn between 2021-25, JPM targets $2.5tn by 2030 of which $1tn is for environmental purposes. Although these numbers are impressive at first glance, they are difficult to compare since they cover different business lines and generally include a much more generous range of products than decarbonisation targets. For example, most sustainable finance targets give credit for capital markets activities such as bond and IPO arrangement. This is rarely included in decarbonisation targets. This means that underwriting a green bond deal will benefit the sustainable finance target but arranging the IPO of an oil and gas company would not impact the decarbonisation target.

Chart 2: Most banks include a broader range of products and services in sustainable finance targets than in their decarbonisation targets (14)

A more comparable measure of a bank’s sustainability practices is Bloomberg New Energy Foundation’s Energy Supply Financing Ratio (ESFR). In simple terms, this is a ratio of ‘green’ to ‘brown’ financing activities where a value greater than 1 indicates more low-carbon investments than fossil fuel activity. As of 2023 the global sector average was 0.9x versus the 4.0x that Bloomberg estimates is required by 2030 to achieve 1.5 degrees of climate warming. This measure is published for many banks and provides comparability but, crucially, it does not include bilateral loans made by banks, which means that no SME or direct corporate lending goes into the calculation. JPMorgan has published its own version of the ratio (15) which considers lending and sits at 1.3x versus the 0.8x estimated by Bloomberg. These metrics are useful, but as the JPM example shows, they are extremely sensitive to assumptions and definitions around what constitutes green and brown activity, so require careful and thoughtful analysis.

While we acknowledge the limitations of these 'single issue' metrics, they have become an increasingly valuable part of our research - especially as the consistency of financing targets reduces. There is no silver bullet and taking a holistic view is important.

GIB AM's approach

Our banking exposure is aligned to our Responsible Finance theme which recognises the role of the banking sector in promoting economic development. We perform a detailed earnings analysis of each company, examining revenue streams, business lines, product categories and customer mix to determine alignment with this theme. While theme alignment is determined through a holistic analysis of a firm’s business model, banks must meet minimum sustainability standards to be considered investable. These include a decarbonisation commitment and no material exposure to fossil fuel related business.

We consider NZBA membership as a good proxy for having a strong decarbonisation commitment but it is neither necessary nor sufficient to pass our standards. We assess banks’ ongoing commitment to sustainability and decarbonisation through a detailed analysis of their sustainability strategy as well as using external resources such as financing ratios. Engagement is an important tool in understanding how firms think about sustainability as well as giving us an opportunity to push for clearer and more consistent disclosure. For many banks that appear aligned with our themes but have limited or confusing disclosure on their sustainability strategy and operations, engagement is a key tool to determine whether the issuer is investible or not. We believe this, combined with our theme and financial analysis allows us to identify firms that most appropriately manage their risk and are positioned to be winners in the long run.

Reference list & disclaimers

1. Tennessee drops BlackRock ESG suit after asset manager agrees concessions

2. Eleven States sue asset managers alleging ESG conspiracy to restrict coal production

3. Insurers' climate alliance relaunches after member exodus

4. Net zero asset managers initiative halts activities in response to threat of US exodus

5. Top American banks exit net zero alliance: What does this mean for their European peers?

6. Norinchukin becomes latest big Japan bank to quit climate group

7. Australia's Macquarie joins major banks in exiting global climate coalition

8. Net Zero Banking Alliance drops binding 1.5C net zero target

9. Barclays follows HSBC in exit from banking industry's net zero alliance

10. UBS has withdrawn from the Net Zero Banking Alliance

11. Net-Zero Banking Alliance Members

12. The Guardian: Standard Chartered CEO decries banks that drop climate pledges

13. VOXEU - Business as usual: Bank net zero commitment, lending, and engagement

14. ShareAction - Mind the strategy gap: how disjointed climate targets are setting banks up to miss net zero

15. JPMorgan - Energy supply financing ratio methodology

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.