The long wait: Bridging the gap between AI spend and revenue realisation

Kunal Desai, CFA

Portfolio Manager

Marcin Lewczuk, CFA

Portfolio Manager

How artificial intelligence investments and Chinese policy making can make meaningful returns

We have long believed the Emerging Markets asset class is a realm for optimists. However, for protracted periods one can feel like Vladimir and Estragon in Samuel Beckett’s Waiting For Godot, where an atmosphere of anticipation and uncertainty can be all pervasive. For those yet to embark on Beckett’s work, the play explores the human condition through two characters endlessly waiting for someone who never arrives. It portrays life’s absurdity, the futility of hope and the search for meaning in a seemingly meaningless existence. Like investors awaiting seemingly elusive market catalysts, both characters’ endless wait mirrors our own pursuit of purpose amidst uncertainty. Heavy stuff!

Both the proposed return profile from Enterprise investments into Artificial Intelligence (AI) and Chinese policymakers’ have tested the market’s patience. So how will this story end? With disappointment and a sense of unfulfillment with the wait for an elusive Godot ongoing? Or will the conclusion of this script be something altogether different? In this piece, which is extracted from our Emerging Markets Quaterly letter, we share our views on bridging the gap between AI spend and revenue realisation.

The payoff of Generative AI

In 2025, Cloud Capex spend will equate to the entire Apollo Space program.1 After two years of significant investment, the market is to see evidence of needle moving results of Generative AI adoption. Now is the time for delivery. Much like the long wait for Chinese policy action, markets have oscillated from exuberant optimism and scepticism about what Enterprise adoption can tangibly mean. The vast ongoing spend on silicon, infrastructure and energy has stimulated credible discussions about the trajectory of GenAI’s ROIC profile – and crucially, which Enablers and Adopters will benefit most.

Much attention has been focused on the US Technology market, and for good reason – this is where the bulk of Enterprise client and correlated IP resides. Several companies in EM offer attractive exposure with multiple levers of underappreciated earnings revisions. An example from Taiwan – Aspeed Technology (5274.TWO) – offers a clear pathway to monetisation shaped by its business model, reinvestment runway and distinct IP-driven competitive advantages.

Aspeed Technology

Aspeed Technology is the world’s leading provider of Baseboard Management Controller (BMC) chips, commanding a dominant 70% market share in the server management sector. BMC chips play a crucial role in modern server management due to their ability to enhance reliability, reduce downtime, improve operational efficiency and enable effective management of largescale server deployments. Aspeed’s dominance is exerted through its early market entry, the specialised nature of BMC technology and relative scale, which creates significant barriers to entry for competition

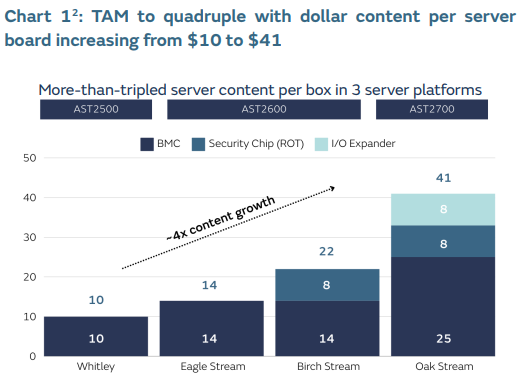

Aspeed’s addressable market is set for substantial growth, with the expectation it will quadruple in size within the next 3 years. This expansion will be driven by server platform upgrades and new chip functionalities. Additionally, Aspeed is poised to benefit significantly from the rise of AI-focused server architectures – an area now representing over 66% of global server capex. It is becoming clear that by upgrading to AI optimised servers, enterprises can significantly enhance their development

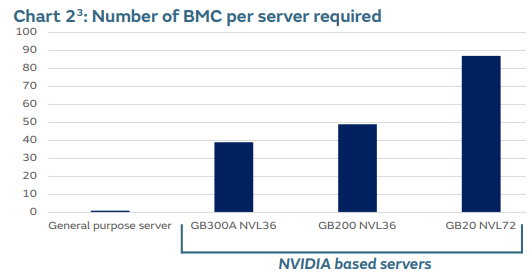

capabilities, improve efficiency and stay competitive in the rapidly evolving AI landscape. For Aspeed, their R&D focus has allowed them to expand their product offerings for server applications, leading to a rising dollar content per server board. Traditional servers typically require only one BMC chip per unit, whereas new NVIDIA-based AI server designs are projected to incorporate up to 52 BMC chips per unit.

Despite a relatively high valuation multiple of 50x 2025 P/E, Aspeed’s underestimated compounding power makes the company an attractive opportunity. The implied free cash flow growth profile to justify today’s valuation can be beaten. With the significant increase in addressable market over the medium term, Aspeed’s technological leadership, strong market share and unique position within the server supply chain provide a solid foundation for future growth. The company’s exposure to the rapidly expanding AI server market presents significant upside potential, which we believe is not yet fully reflected in the company’s valuation.

Concerns remain that the shipment of Aspeed’s BMCs to general servers would be affected by the higher shipment of AI servers. However, with the increased number of BMC units in NVIDIA’s latest server racks, a higher ASP for the new BMC product and the usage of additional ancillary products that Aspeed are building expertise in, this risk is overestimated.

Specific to our strategy, Aspeed’s management have demonstrated high responsiveness to shareholder engagement. Following our interactions, they have introduced changes to the Board of Directors’ structure, including adding the first female member. The next priority for our engagement is focusing on ESG targets and incorporating them into management KPIs.

In the context of wider concerns about whether AI investments can result in tangible value creation, Aspeed stands out favourably. Its robust business model, coupled with the transformative AI opportunity, positions the company for significant growth. Its ability to adapt to the AI server market, command premium pricing, and maintain a strong competitive position through intellectual property makes it a compelling investment case in the evolving landscape of server technology.

Our weighting to Technology stands at 34.7%, of which over half is exposed to companies directly benefitting from tangible AI-linked value creation. Such opportunities provide a wide array of business models with the power to compound capital at high rates of return. While the market has been looking expectantly towards the US, we feel many have overlooked the AI opportunities that have already arrived in EMs.

In a world of growing scepticism about those companies which are ‘false’ AI plays, this can be a potent driver of incremental returns for the strategy

References

- Real terms, Morgan Stanley, 2024

- Company data, JP Morgan, 2024

- Company and GIB AM Analysis, 2024

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.