China’s response: What it takes for this time to be different

Kunal Desai, CFA

Portfolio Manager

The art of waiting: Investment lessons from Godot

Chinese policy making and how artificial intelligence investments can make money

We have long believed the Emerging Markets asset class is a realm for optimists. However, for protracted periods one can feel like Vladimir and Estragon in Samuel Beckett’s Waiting For Godot, where an atmosphere of anticipation and uncertainty can be all pervasive. For those yet to embark on Beckett’s work, the play explores the human condition through two characters endlessly waiting for someone who never arrives. It portrays life’s absurdity, the futility of hope and the search for meaning in a seemingly meaningless existence. Like investors awaiting seemingly elusive market catalysts, both characters’ endless wait mirrors our own pursuit of purpose amidst uncertainty. Heavy stuff!

Both Chinese policymakers’ and the proposed return profile from Enterprise investments into Artificial Intelligence (AI) have tested the market’s patience. So how will this story end? With disappointment and a sense of unfulfillment with the wait for an elusive Godot ongoing? Or will the conclusion of this script be something altogether different? In this piece, which is extracted from our Emerging Markets Quaterly letter, we share our perspectives on Chinese policymakers – with the ultimate lesson pointing to the anticipation of arrival being as powerful as the endgame itself. Our views on bridging the gap between AI spend and revenue realisation will be explored in our next insight piece.

China’s response: What it takes for this time to be different

In our last Quarterly letter, we argued: “a two-speed growth model still prevails in China, under which policymakers rely on external demand, export growth and manufacturing capex to achieve growth targets. When could such a twospeed model come to an end? A slowing global economy or rising trade protectionism. Were this to manifest (a high likelihood outcome), policymakers in China would be ‘forced’ into a shift towards aggressive policy support towards the hitherto sagging property market. Consumer animal spirits would be likely revived. Our basket of portfolio companies which are aligned with Quality, Growth and Profitability would see a dramatic resurgence at the expense of Defensive & Cyclical Value."

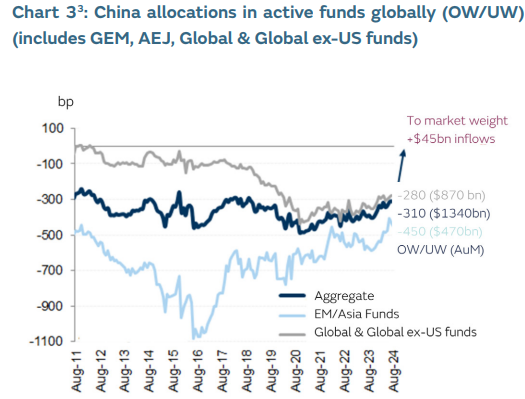

Timing is notoriously tricky in investing, but we weren’t left waiting for long. Since 24 September, more than 10 key measures and consultation papers that span across the monetary, fiscal, property, and equity market cohorts have been announced by various agencies. The magnitude, breadth and comprehensiveness of this easing package is one of the most significant in recent times. As we had expected, such measures underscore policymakers’ commitment to defend and achieve the 5% GDP growth target and instill stability and confidence in markets. A ‘pain threshold’ has now been revealed with investors quickly repositioning to benefit from the wave of unprecedent and unorthodox policy support. In light of Trump's recent election victory, we believe there remains room left to run. Positioning is clean and the shift of capital sponsorship from DM to EM looks to be in motion. The profit outlook for Corporates has improved – despite more stimulus likely required to transform China into an inflationary force globally. The recent Fed cuts have loosened one constraint on China stimulus, whilst potential new US tariffs on Chinese goods (post US presidential election) might actually increase the intensity and longevity of it. It is noticeable that the market sensitivity to such incremental policy steps is high: the recent rally in Chinese equites (+40% from their lows) has meant China's outperformance versus the rest of EM in the past three weeks is the widest in the past 25 years.

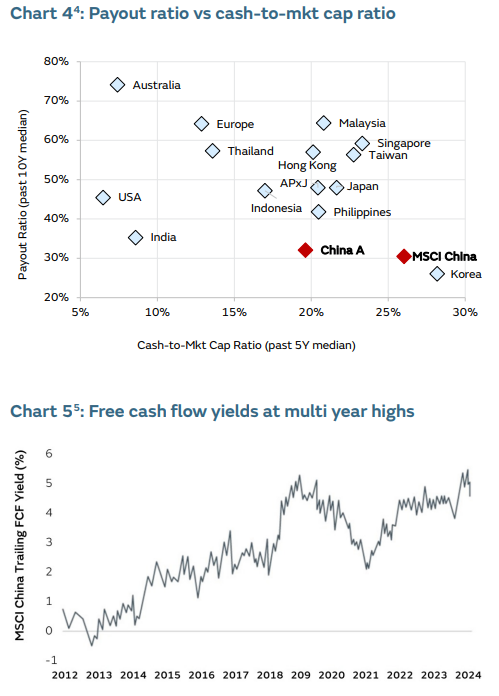

The self-help story for Chinese corporates remains attractive – valuations have de-rated largely on terminal growth downgrades (which are now shifting with updated policy priorities) and a higher cost of capital (geopoliticsdriven country risk premia). Corporate fundamentals and business balance sheets are healthy, and as Chart 4 shows, China provides best in class optionality for an improvement in capital returns to shareholders. Cash balances as a percentage of market cap are high, whilst payout ratios are low. Free cash flow yields continue to climb. This aligns with our engagement work with portfolio companies where Strategic Capital Allocation decisions to improve shareholder returns through higher capital returns is a potent lever to pull.

Chinese self help: Companies are in a strong position to return cash to shareholders

China’s easing has triggered a broadening in the EM equity rally. With an improving macro cycle led by Fed easing and these much-needed coordinated Chinese stimulus announcements, EM have staged an impressive rally with the EM index up +11% from mid-September lows and +17% year to date.

But where to from here? Whilst we would urge investors who have so far missed out on the China rally to reappraise the opportunity, more needs to be done for a structural re-rating to sustain. For most investors, Japan’s experience through the 1990s is something most easily uncovered in economic textbooks. However, it is Japan that provides the clearest explanation of the challenges facing China and the remedies required for its turnaround.

The debate about Japan’s lost decades continues. Paul Krugman points to a missed opportunity to adopt ‘credibly irresponsible’ shock policies.6 This implies the Bank of Japan waited too long to act whilst fiscal packages were not enough to reverse the trajectory of the deflationary spiral. Instead policies were insufficiently aggressive – failing to dislodge the embedded disinflationary mentality and force savings rates down, thereby failing to release Japan from the iron grip of excessive investment, overcapacities and disinflation. Comparing the Japanese experience with China today, there are some notable similarities. First, both economies encountered a prolonged period of structurally high savings rates without consistent policies to consume such savings. Second, the only answer in both cases was an excessive reliance on investment and exports. Third, this resulted in disinflation and falling return on investments. It’s here where deflationary spirals kicked in – as disinflation intensified and returns dropped, households and corporates scaled back expenditures, expecting lower future prices whilst demanding greater savings cushions. The longer such spirals persist, the more dangerous they can be – timidity and biding time is not a sensible strategy.

Fast forward to today, we’re unsure if China wishes to embrace such ‘credibly irresponsible policies’. It remains critical for policymakers to attack the most problematic symptom – not the cost of supply of money, but rather the lack of demand for money. We remain hopeful this can be achieved and are looking out for a number of policies that could structurally re-rate Chinese equities, which in turn would have important implications for portfolio positioning.

Firstly, the quantum of state support should be adjusted higher to at least 5% of GDP. By way of comparison, the current RMB 2tn (USD 285bn) expectations amount to ~1.5% of GDP with only ~0.5% earmarked for Real Estate. The TARP and ARRA program of the USA in 2008-9 equaled ~10% of GDP, whilst China’s fiscal expansion post GFC totaled ~12% of GDP. The sums proposed by China today are particularly paltry given their property overhang is five times larger than the USA in 2008-9. Secondly, an initiative to transfer a significant portion of local and SOE debt to central government books would help place local governments on a viable revenue footing. Thirdly, an acceleration in plans to raise and equalise China-wide universal basic income. Most of China’s problems stem from a structurally high savings rate (~45% of GDP) which compound the issues of excessive investment, misallocation of resources, overcapacities, disinflation and over reliance on exports.

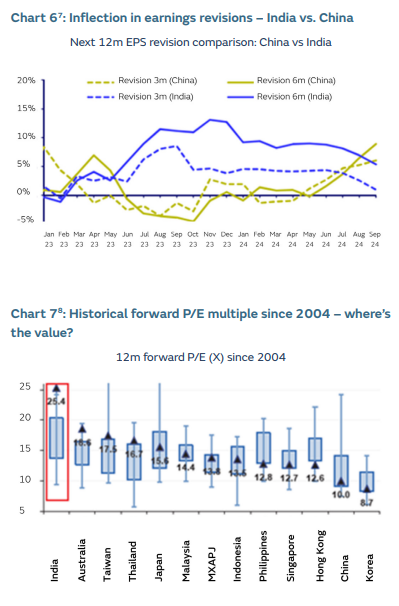

Our weighting towards China sits at 27.5% which is marginally higher than the Index’s weighting of 25.6% and materially higher than many of our peers. Our timing of adding to China through early 2024 was reasonable since Chinese equities have clearly improved from the nadir in late January. As China rallies, pressures on India will rise, particularly as Indian growth indicators moderate, valuations appear stretched against history and an unprecedented IPO schedule sucks liquidity from markets.

Conclusion

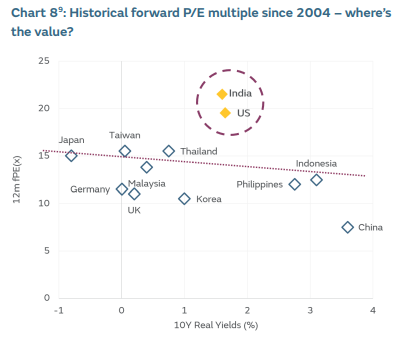

Whilst it remains clear that India stands as EM’s most scalable and secular investment opportunity, we would highlight the growing valuation risk. This is particularly concerning in portfolios where existing US exposure is combined with India as the sole EM expression. For all its virtues, India is the most expensive market in the world on absolute valuation plus relative to history on P/E multiples. Comparing Indian equity valuations to bond yields is now at levels which historically led to depressed 2-year absolute market returns. Various sell side Bull-Bear indices suggest levels of exuberant extremes which imply some form of pullback is entirely reasonable.

For us, the case for owning a global EM portfolio (rather than India standalone) is getting stronger. India will remain an important allocation in our portfolio given the durability of the secular story, however the case for EM beyond India now shines even brighter for those scanning the horizon.. Compelling opportunities in our Watchlist and Portfolio from South Korea, SE Asia, Brazil, Mexico, Taiwan, Poland and Turkey merit close attention. And of course, China – an unloved market with penalised expectations – is presenting a fascinating tactical opportunity today, driven by the expectation of tomorrow.

This piece is an extract from our GIB AM Emerging Markets Active Engagement Quarter 3 letter. If you would like to read the report or hear more from our team, please email info@gibam.com

References

- Haver Analytics (2024)

- Goldman Sachs, Lipper (2024)

- Bloomberg, Goldman Sachs and GIB AM (2024)

- Bloomberg, MSCI China and GIB AM (2024)

- Macquarie Research (2024)

- CLSA, FactSet, MSCI (2024)

- Goldman Sachs (2024)

- Goldman Sachs (2022)

- Real terms, Morgan Stanley (2024)

This content should not be construed as advice for investment in any product or security mentioned. Examples of stocks are provided for general information only to demonstrate our investment philosophy. Observations and views of GIB AM may change at any time without notice. Information and opinions presented in this document have been obtained or derived from sources believed by GIB AM to be reliable, but GIB AM makes no representation of their accuracy or completeness. GIB AM accepts no liability for loss arising from the use of this presentation. Moreover, any investment or service to which this content may relate will not be made available by GIB to retail customers.