GIB AM proud to receive high scores in its Principles of Responsible Investment (PRI) annual assessment

08/20 GIB Asset ManagementLondon 18 August 2020

- GIB AM achieves excellent results in its PRI annual assessment;

- All scores for reported categories were at, or above, the median;

- Good progress demonstrated since last year.

Commenting on the results, Katherine Garrett-Cox, CEO of GIB AM said: “I am delighted to have received recognition for our comprehensive responsible investment practices.”

“We find the PRI a useful framework for ensuring we continue to push ourselves to improve, and are pleased that our efforts have been recognised in this year’s assessment. There is more we can all do, such as raising the quality of analysis around climate-related risks, and improving data availability, transparency and analytics to assess and measure impact.”

2020 assessment

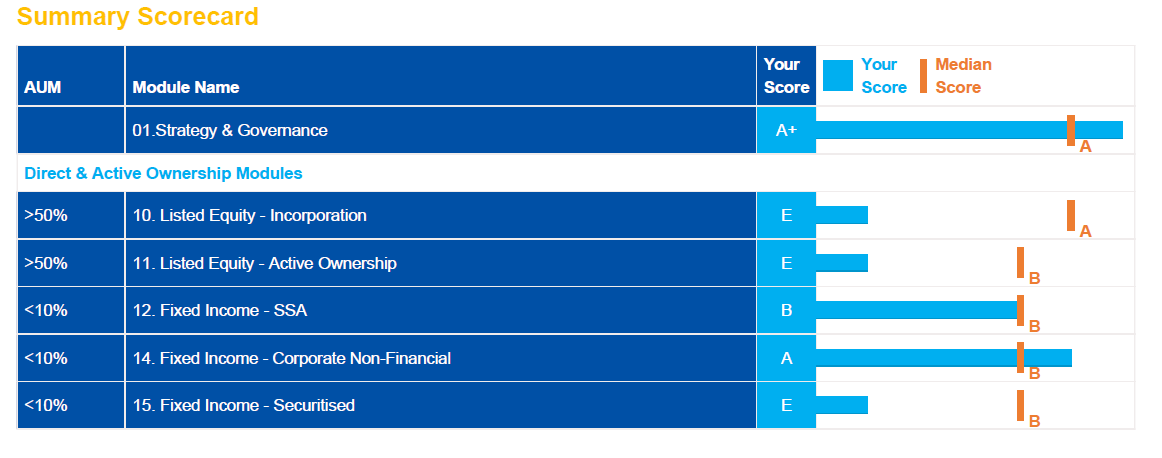

GIB AM received strong results for all its reported categories.

The top score (A+) was awarded for the critical strategy and governance module.

Its fixed income capability received an A for corporate non-financials (against a median of B), and B for sovereign debt (in line with the median).

The bulk of GIB AM’s assets under management are passive equity, so a specific assessment was not made against these.

Source: PRI assessment report, PRI. Note categories showing as ‘E’ were not relevant for GIB AM and not reported.

Progress since 2019

GIB AM became a signatory to the PRI in 2018, so this was only the second year that an assessment was conducted. Significant progress was demonstrated across all areas, consistent with our commitment to be a responsible investment provider and adopt the principles across all that we do.

Notable improvements included:

- Publication of our responsible investment policy and associated documents;

- Deepening of ESG research on fixed income issuers;

- Enhancements to responsible investment processes to ensure approach is robust;

- Increased disclosure of approach publically and to clients/beneficiaries;

- Development and publication of stewardship policy.

As a result, the score for the Strategy and Governance module increased to A+, from B. The fixed income corporate non-financials module score increased to A, from C. The fixed income SSA module was not completed in 2019.

Background on the PRI

The PRI is the world’s leading proponent of responsible investment. It works:

- to understand the investment implications of environmental, social and governance (ESG) factors;

- to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.

Each year, signatories must complete an assessment against the six core principles. This year, for the first time, it was mandatory to complete an assessment against the recommendations of the Taskforce for Climate-related Financial Disclosure (TCFD).

For the full report, please see: 2020 Assessment Report for GIB UK

Our latest views

View our latest insights and news, as well as our research series on sustainable investments